Gold breaks key barriers on 1.2% advance on Tuesday

Gold price jumped to 1 ½ month high on Wednesday, mainly driven by weaker dollar on changing US rate outlook.

Although US retail sales missed expectations in June (data released on Tuesday) spending remains resilient despite strong rise in borrowing cost, adding to positive signals from easing inflation, which is likely to prompt Fed to end its tightening cycle in the near future.

Recent economic data showed that the US economy is in better shape than anticipated and analysts are optimistic in their expectations that the US will avoid recession.

Brightening rate outlook keeps the dollar under pressure and boosts demand for the yellow metal, but gains might be limited as the start of cutting rates is unlikely in the near future.

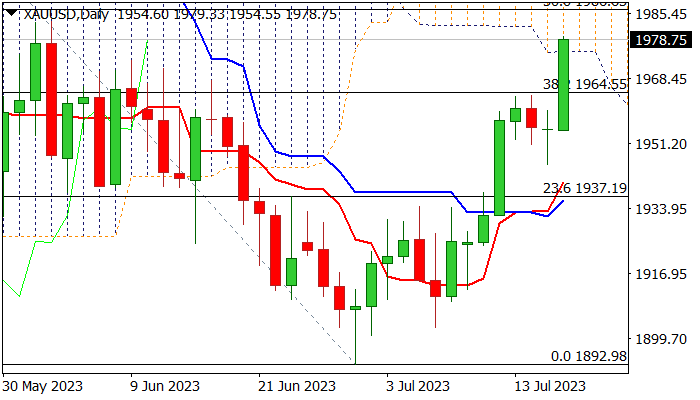

Fresh strength signals continuation of an uptrend from $1892 (June 29 low) after brief consolidation in past three days.

Bulls broke through important Fibo barrier at $1964 (38.2% retracement of $2080/$1892) and penetrated into falling daily cloud (cloud base lays at $1975) with close within the cloud needed to confirm fresh bullish signal.

Daily studies are in full bullish setup, but overbought conditions warn that bulls may start to lose traction.

Dip-buying for rally towards $1986 (Fibo 50%) and $2000 (psychological) in extension, to remain favored while the price stays above broken Fibo 38.2% barrier at $1964.

Res: 1986; 2000; 2006; 2008

Sup: 1975; 1964; 1956; 1945