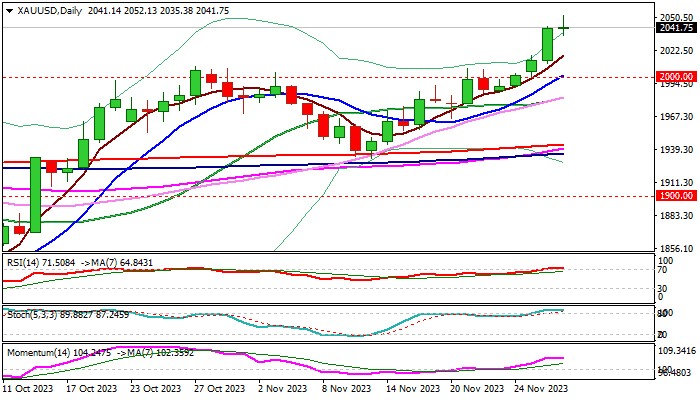

GOLD – bulls are pausing but hold grip for fresh acceleration higher

Gold prices eased from new highest level in over six months on Wednesday as investors collected some profits from the latest acceleration in past four days.

Overbought daily studies also contributed to such decision, although dips were so far very limited, signaling that bulls hold grip for further advance.

The metal received strong support from growing signals of an end of Fed’s tightening cycle and expectations that the central bank may start cutting rates in May 2024.

The latest dovish comments from Fed officials contributed to bullish outlook and sparked strong acceleration on Wednesday (the biggest daily gain since Oct 13), in addition to geopolitical tensions and uncertainty about economic growth, which continue to fuel safe-haven demand and lift gold price.

Bulls eye peaks of 2020 / 2022 ($2074 / $2070) and all-time high at $2080, posted on May 4 this year, with shallow pullbacks to be ideally contained at $2010 support zone and guard lower pivots at $2000 zone (psychological / 10DMA).

Res: 2052; 2070; 2074; 2080

Sup: 2035; 2018; 2010; 2000