Gold -bulls continue to face headwinds but eye support from Fed rate pause

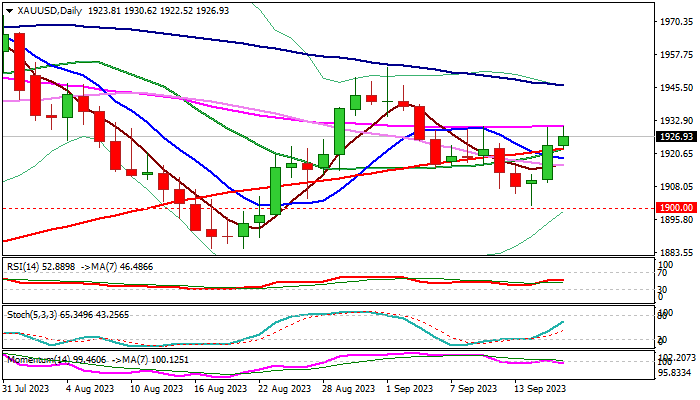

Gold retested key near-term barrier at $1930 on Monday, but was so far unable to break higher, following recent triple rejection at this level, where 55DMA repeatedly capped attacks.

Renewed strength after last week’s double upside failure and subsequent pullback to $1900 signals that bulls hold grip, but with persisting downside risk while the action remains capped by $1930 barrier.

Daily studies improved as MA’s mostly turned to bullish setup and daily cloud twist ($1940) also seen magnetic but remain weighed by negative reading of 14-d momentum.

On the other hand, fundamentals work more in favor of the yellow metal, particularly on expectations that the Fed will stay on hold on policy meeting this week and may shift its projections more into dovish mode, as economic growth is steady, inflation cooled, and the labor market is overall tight, all pointing to fading downside risk and a soft landing scenario.

Gold should appreciate in conditions of lower dollar demand, though sustained break through $1930 and nearby Fibo barrier at $1933 (Fibo 61.8% of $1952/$1900) remains a major requirement for bullish continuation signal.

Lift above $1930/33 to expose targets at $1940 (Fibo 61.8%) and $1946 (100DMA), guarding key barrier at $1952 (Sep 1 high).

Alternatively, repeated failure at $1930 would keep the downside vulnerable, with initial bearish signal seen on loss of 200DMA support ($1922), which would weaken near-term structure.

Res: 1930; 1933; 1940; 1946

Sup: 1922; 1913; 1909; 1900