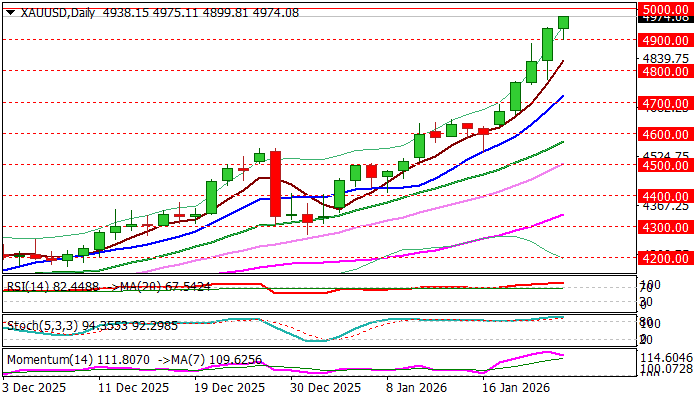

GOLD – bulls increase pressure on magic $5000 barrier

In one of my daily briefings earlier this week, I was asked whether the gold is going to hit $5000.

My answer was that this may occur the earliest on Friday (today) or sometime next week.

With persistently favorable conditions, it is not so difficult to predict the action in the near future, as a cocktail of factors that drive the metal’s price in one year or so, hasn’t significantly improved but continues to deteriorate and boost exodus into safety.

Gold is about to end week with strong gains (about 7%) and on track for the record monthly gain in January (almost 15%), in the steep rally that extends into sixth consecutive month.

Although the price approached magic $5000 barrier, where it is expected to face strong headwinds, partially due to significance of resistance and partially due to strongly overbought conditions on all larger timeframes, bulls so far firmly hold grip.

High uncertainty on deteriorating geopolitical and economic situations, keeps investors very cautious, with focus continuously shifted to the upside.

Today’s shallow dips stayed above initial support at $4900, despite strong negative technical signals and expectations for more significant profit taking at the end of the week.

I believe that the most we may see would be extended and narrow consolidation, before final attack at $5000 trigger, violation of which to likely spark stronger acceleration higher, as number of stops are parked above.

Sustained break higher will keep us in uncharted territory, where we will look for targets at $5065 (Fibo projection), $5100 (round figure) and $5182 (Fibo projection).

Res: 5000; 5065; 5100; 5182

Sup: 4944; 4900; 4834; 4800