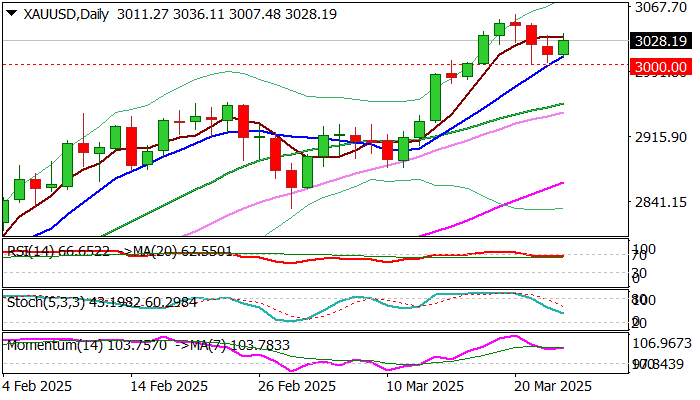

Gold – bulls regain traction after a double rejection at key $3000 support

Gold price bounced on Tuesday after a double failure on important $3000 support signaled that shallow correction from new record high might be over.

Persisting uncertainty over the magnitude of negative impact from looming US reciprocal tariffs on global economy and fragile geopolitical situation, keep strong safe haven demand.

Investors are also concerned by signals of slowdown of the US economy, which adds to factors that fuel migration into safety, although the latest calmer tones about tariffs from President Trump, may slow the process.

As I mentioned in my previous comments, near- term action is expected to remain biased higher as long as the price stays above $3000, with limited dips to provide better levels to re-enter larger bullish market.

Overall bullish daily studies support the notion, with today’s close above $3033 (Monday’s high / 5DMA) to validate bullish signal and open way for fresh acceleration towards all-time high ($3057).

Res: 3036; 3047; 3057; 3079

Sup: 3021; 3009; 3000; 2981