Gold – bulls take a breather ahead of attack at $4000 barrier

Good morning from the floor of Dubai EXPO 2025.

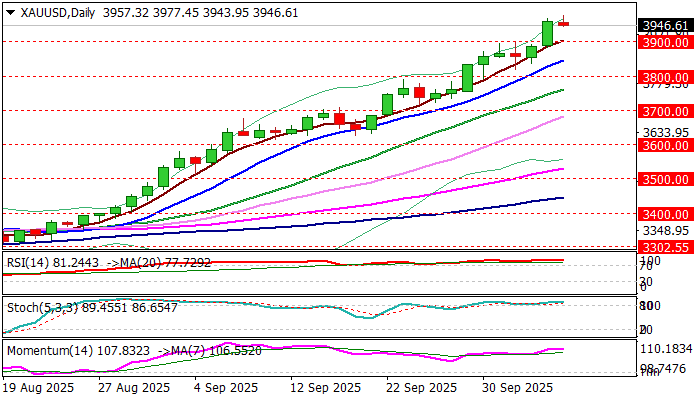

Gold remains top market performer, with some consolidation seen in early Tuesday’s trading, after the yellow metal’s price surged through $3900 and hit new record high at $3977 on Monday, challenging very significant $4000 barrier.

A cocktail of key factors (high bets for Fed’s 0.25% rate cuts in Oct and Dec, growing uncertainty over darkening geopolitical and macroeconomic outlook, as well as the latest political turmoil which resulted in US government shutdown and resignation of French PM and the second no-confidence vote for EC President Ursula von der Leyen in just three months) that moved gold price lately, continue to fuel bullish sentiment.

Bulls started to face headwinds on approach to $4000 level and from very overbought environment on daily chart, although dips were so far quite shallow, as traders do not want to take too much risk now.

Dips still hold above initial support at $3940 (Fibo 23.6% of $3819/$3977 upleg), guarding trendline support / hourly higher low ($3926) and more significant Fibo 38.2% at $3916 and rising hourly cloud top at $3912, which should ideally contain pullback.

Only loss of $3900 zone (psychological / 50% retracement of $3819/$3977) would dent larger bulls and open way for deeper correction.

Res: 3955; 3977; 4000; 4020

Sup: 3940; 3926; 3916; 3900