Gold consolidates under new record high, remains underpinned by strong safe haven demand

Gold price holds within a narrow consolidation on Tuesday and steadies above $2800, following Monday’s roller coaster, inspired by US tariffs.

Sharp dip was short-lived and followed by quick recovery that pushed the price to new all-time high, suggesting that demand for safe haven metal remains strong.

Traders remain concerned about growing risks as trade war between US and China (after President Trump put implementation of tariffs to Canada and Mexico on hold) is likely to escalate after China announced their list of measures against US companies and goods.

Growing concerns about consequences of negative impact of trade war (instability, supply disruptions, higher inflation, slower economic growth) are likely to keep gold price underpinned.

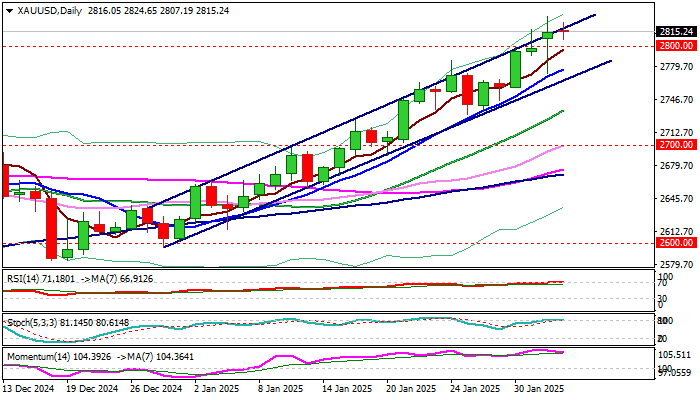

Repeated daily close above $2800 level to boost initial positive signal and push the price through cracked bull-channel trendline resistance, to validate signal.

Bulls eye targets at $2849 and $2886 (Fibo projections 123.6% and 138.2% respectively) with stronger bullish acceleration to open way towards psychological $3000 barrier.

Broken $2800 level reverted to initial support, followed by $2785 (Jan 24 high) and lower triggers at $2771 (Monday’s spike low / bull-channel trendline support.

Res: 2830; 2849; 2886; 2900

Sup: 2800; 2785; 2771; 2758