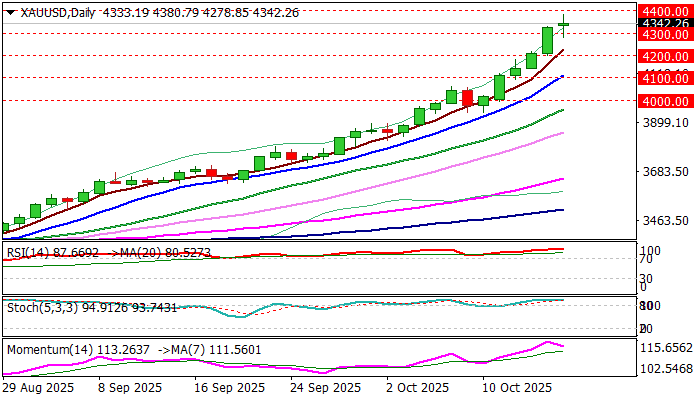

GOLD continues to hit new record high in each session, peaks near $4400 on Friday

Gold continues to hit new record high on daily basis and rose to $4380 in early Friday trading, after the metal rallied 2.8% on Thursday and closed above $4300, recording new fastest move between two round-figure levels of just one day.

The yellow metal remains in strong uptrend which accelerates and steepens in growing euphoria over historical rally into safety.

Gold is also on track for weekly gain of over 8%, which marks the best week since September 2008, as the price was up almost $400 during the past five days and has advanced around 66% from the beginning of the year.

Growing trade tensions between the US and China, which threaten of uncontrollable escalation, tough rhetorics of Moscow, Washington and NATO over the war in Ukraine, fragile peace in the Middle East, clouded political and economic situation in a number of developed countries and strong demand for physical gold from central banks continue to fuel gold’s rally, with the newest signs of weakness in US regional banks, adding to the cocktail of key factors that continue to lift metal’s price.

Bulls remained resilient despite strongly overbought daily and weekly studies, but some price adjustment is likely to be seen soon, as 14-d momentum turned south and strongly overbought \RSI turned sideways, generating initial signal.

However, potential consolidation or correction is likely to be limited and probably mark positioning for fresh push higher, if current strongly supportive environment persists.

Broken $4300 level, although being cracked, marks initial support, with deeper pullback to ideally hold above $4200 (psychological / Thursday’s low) and not exceed rising daily Tenkan-sen ($4160) to keep bulls in play for probe through $4400 and possible attack at $4500, which now marks key barrier.

Res: 4380; 4400; 4422; 4500

Sup: 4300; 4278; 4200; 4160