Gold dips 3% today but larger bulls remain firmly in play

Gold fell almost 3% on Monday, but drop was mainly result of increased volatility in the market, as trades liquidated profitable positions on gold to get extra money to cover shortages on margin calls from losses in the stock markets.

Although today’s fall is significant and the biggest daily loss in two months, I don’t see reasons for panic, but instead, expect these dips to provide better buying opportunities.

Near-term price is still within the range of past couple of weeks and far from key supports at $2290 zone, suggesting that larger bulls remain in play and current weakness seen as temporary and limited.

Rising geopolitical tensions and fresh signs of potential recession in the US, keep markets highly alerted for stronger move into safety, should conditions deteriorate further, so the gold hasn’t really lost much of its safe-haven appeal, but currently positioning for final push through $2500 and attack at psychological $3000 barrier.

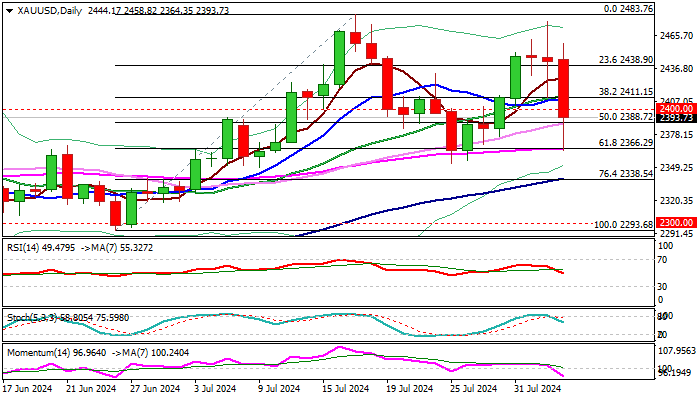

Initial support at $2366 (55DMA /Fibo 61.8% of $2293/$2483 upleg) has provided a temporary footstep to today’s drop, guarding $2238 (100DMA / Fibo 76.4%) and key $2300/$2290 zone).

Return and close above $2400/10 zone to ease downside pressure and brighten near-term outlook.

Res: 2462; 2474; 2483; 2500

Sup: 2430; 2410; 2400; 2376