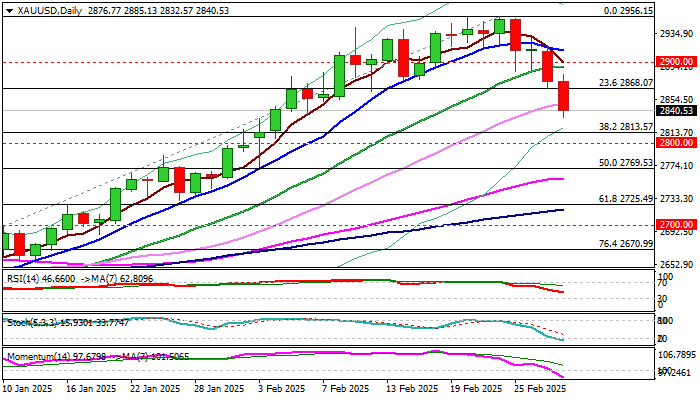

Gold – extended pullback approaches key $2813/00 support zone

Gold remains in red for the fourth straight day and hit the lowest levels in three weeks on Friday.

The yellow metal is also on track for a weekly loss of 3% and the first bearish week after nine consecutive weeks of gains, while the monthly action of February was shaped in green Doji candle with long upper shadow which signals increased offers.

Gold was hit by stronger dollar, which took over primacy as major safe haven asset in fresh risk aversion on growing economic and geopolitical uncertainty, and was also underpinned by elevated US inflation.

Weekly close below former pivotal supports at $2900 / $2877 (psychological / Feb 14/17 higher base), and $2868 (Fibo 23.6% of $2582/$2956 rally) to validate negative signal as bears eye next significant supports at $2813/00 (Fibo 38.2% / round-figure level).

Stronger headwinds could be expected at this area, with consolidation to possibly precede fresh push lower, if negative fundamentals persist.

Alternative scenario, in which pullback will be contained at $2813/00 zone, to mark a healthy correction before larger bulls take over the control, is still in play, so watch the reaction at this area.

Res: 2868; 2885; 2900; 2914

Sup: 2845; 2813; 2800; 2769