Gold falls 2% on fading safe haven demand

Gold price fell around 2% on Monday as safe haven demand faded on calmer tones from the Middle East, which ease fears for conflict escalation.

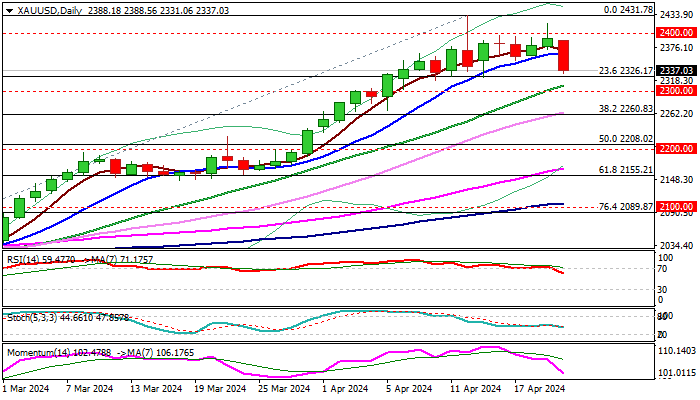

Traders partially collected profits after gold repeatedly failed to sustain gains above psychological $2400 level and bull-trap pattern is forming on daily chart.

Fresh bears pressure the first pivots at $2320 zone (recent range floor / Fibo 23.6% of $1984/$2431), loss of which would add to initial negative signals (the price broke below 10DMA and is sharply losing bullish momentum) and allow for deeper pullback.

Psychological $2300 level and Fibo 38.2% ($2260) mark next significant supports, with the latter marking a pivotal support, which should contain extended dips to mark a healthy correction and not harm larger bulls.

Conversely, clear break of $2260 pivot to sideline bulls and shift near-term focus to the downside.

Res: 2363; 2400; 2417; 2431

Sup: 2320; 2300; 2260; 2222