Gold hits new record high

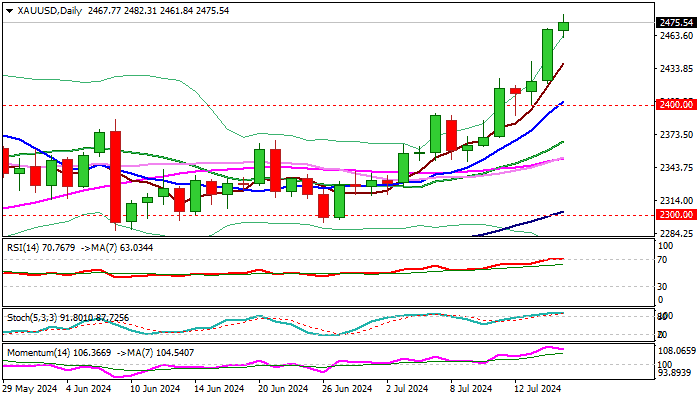

Gold hit new record high early Wednesday ($2482), following acceleration through former top on Tuesday (metal was up 1.9% for the day, the biggest daily gain since Dec 13).

Break above previous all-time high ($2450) signaled an end of corrective phase ($2450/$2286) and continuation of a larger uptrend.

Growing expectations for September Fed rate cut, fueled by the recent US inflation data and dovish comments from Fed officials, sparked fresh demand for the yellow metal.

Bulls approach immediate target at $2500, but may accelerate further, as favorable conditions on US rate outlook were boosted by heated geopolitical situation, as well as expectations that demand from gold’s top consumer China will remain strong, despite a pause in metal purchases in May and June.

Gold price entered uncharted territory again, with violation of $2500 barrier to expose targets at $ 2512/51/74 (Fibo projections).

Meanwhile, increased headwinds should be expected on approach to $2500 barrier, as daily studies are overbought.

Limited profit-taking is likely to mark a price adjustment before fresh push higher, with former top ($2450) and $2400 (psychological, reinforced by 10DMA) now acting as solid supports and expected to keep the downside protected.

Res: 2500; 2512; 2551; 2574

Sup: 2461; 2450; 2400; 2368