Oil price falls nearly 2% but key supports still hold

WTI oil price fell nearly 2% on Tuesday, on track for the biggest daily loss since June 3, as growing worries about weaker demand from China and more signals for Fed September rate cut, soured sentiment.

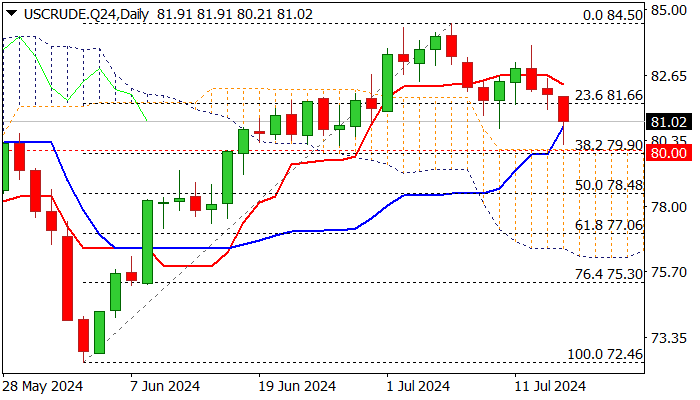

Fresh bears hit the lowest in three weeks but faced strong headwinds on approach to pivotal barriers at $80.00/$79.90 (psychological / Fibo 38.2% of $72.46/$84.50 / top of thick daily Ichimoku cloud).

Mixed daily studies still lack clear direction signal, with sustained break of $80.00/$79.90 zone, to generate strong bearish signal (reinforced by completion of failure swing pattern on daily chart) and risk extension towards $78.71//48 (200DMA / 50% retracement).

Upticks should be capped under $81.66 (broken Fibo 23.6%) to keep alive hopes for fresh push lower, otherwise, bounce above this level would dent renewed bears and probably generate an initial signal of a healthy correction of the larger uptrend.

Res: 81.66; 82.06; 82.56; 83.00

Sup: 80.00; 79.90; 79.15; 78.71