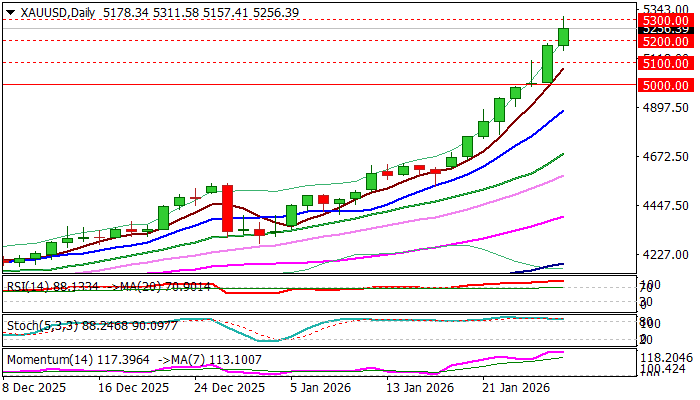

GOLD hits new record high above $5300

Gold cracked $5300 barrier and hit new record high ($5311) in early Wednesday, remaining in steep and uninterrupted rally that has registered the fastest moves from one to another round-figure level (less than 25 hours), after the price broke psychological $5000 barrier.

The latest strong fall of dollar (Tuesday) that pushed the currency to the lowest in four years and primarily driven by growing crisis of confidence in some US assets, contributed to yellow metal’s recent acceleration, along with dominant geopolitical factor, as well as political earthquake on growing US – EU tensions, endless tariff saga and clouded macroeconomic outlook.

Traders remain extremely cautious and refrain for now from any significant profit-taking action despite screaming overbought indicators on daily chart that keep the price well supported.

This contributes to scenario of shallow dips preceding fresh push higher, as pullback is evident on hourly chart, along with sort of bull-trap pattern above $5300 barrier, hourly RSI emerging from overbought zone and loss of positive momentum.

Broken $5200 level (reinforced by rising 20HMA and near Fibo 38.2% of $4990/$5311 upleg) offers solid support which should ideally contain dips and mark a healthy correction before larger bulls regain control.

Conversely, loss of $5200 handle would risk deeper drop and expose supports at $5150 (Fibo 50%) and $5100 (round-figure, former strong resistance).

Sustained break of $5300 barrier would unmask targets at $5384 (Fibo 200% expansion of five-wave cycle from $3997, Nov 18 low); $5400 (round-figure) and $5500/14 (round-figure / FE 223.6%).

Res: 5277; 5311; 5384; 5400

Sup: 5235; 5200; 5150; 5100