Gold hits new record high, on track for strong weekly, monthly and quarterly gains

Gold spiked to new record high ($3086) in early Friday trading, in extension of Thursday’s 1.2% advance.

The yellow metal is on track for the fourth consecutive weekly gain and also for the third straight bullish monthly close (over 7% up in March), with the price increasing by 17% in the first three months of 2025.

Gold price was lifted by rising safe have demand, driven by growing economic, and geopolitical uncertainty, signals or more rate cuts, as well as increased physical buying

The latest story with US reciprocal trade tariffs further fueled concerns of trade war escalation which could cause a colossal negative impact on global economy and further boost migration into safety.

Short term outlook is likely to remain very bullish, as there are no signs that situation in any of key fields would calm soon, but more likely to deteriorate further.

The notion is also supported by quick and easy break of $3000 milestone, where stronger headwinds were expected, due to significance of this psychological barrier, with fresh acceleration higher coming close to next round figure resistance at $3100.

Some easing could be anticipated here, due to week-end and month-end profit taking, though gold’s major drivers remain firmly in play, suggesting that dips are likely to be limited.

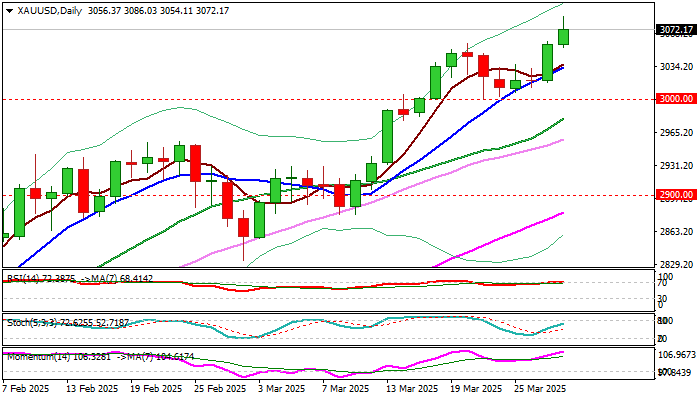

Technical picture is firmly bullish on daily chart, although stretched indicators warn that bulls may take a breather.

Previous top at $3057 offers immediate support, followed by rising 10DMA ($3033) where dips should ideally find a footstep and guard lower pivot at $3000 (former key barrier reverted to strong support).

Res: 3086; 3093; 3100; 3112

Sup: 3057; 3033; 3012; 3000