Gold is consolidating after 4.6% advance last week, US inflation data eyed for fresh signals

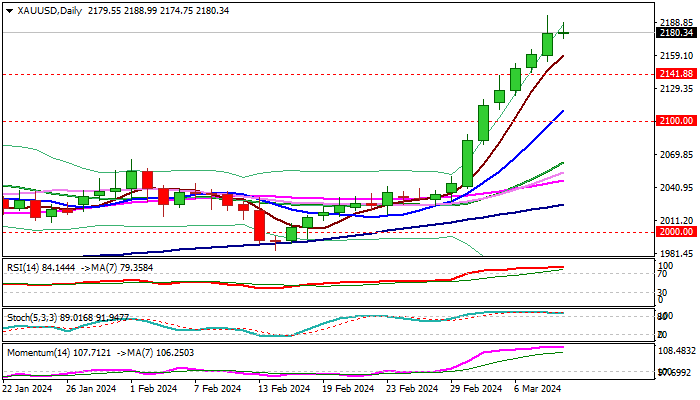

Bulls are taking a breather and consolidating within a narrow range on Monday, just under new all-time high ($2195) and psychological $2200 barrier.

The yellow metal continues to shine (advanced 4.6% last week, in the biggest weekly gain since the second week of March 2023), lifted by growing expectations for Fed rate cut.

Strongly overbought conditions on daily chart suggest that traders may opt for partial profit taking, although relatively quiet trading on Monday, also indicates that markets await fresh signals from US inflation data, due on Tuesday.

Gold will likely rise further if February numbers confirm that inflation remains in a downward trajectory which will add to expectations for the first rate cut in June.

Conversely, higher than expected figures would raise worries about persisting price pressures and probably cool the expectations for the start of policy easing, as Fed Chief Powell said last week that the central bank’s policy decisions will directly depend on inflation data.

Initial support lays at $2174 (session low) followed by rising 5DMA ($2158), former top at $2141 and daily Kijun-sen / psychological ($2019/$2100 respectively).

Immediate resistances lay T $2200/06 (psychological / Fibo 138.2% projection), with sustained break of $2200 zone to expose targets at $2245 (161.8%) and $2270 (176.4% projection) in extension.

Res: 2195; 2200; 2206; 2245

Sup: 2174; 2141; 2100; 2088