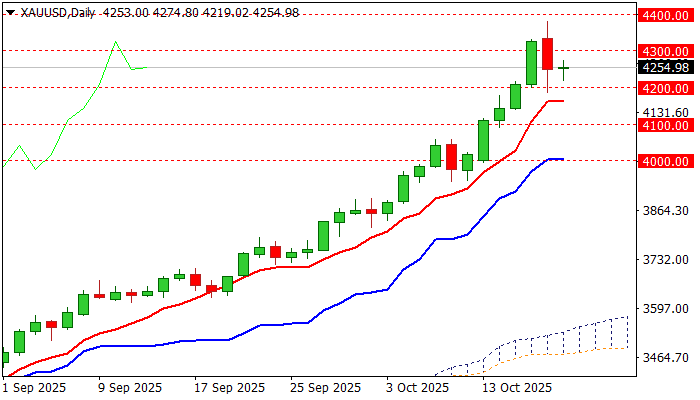

GOLD is consolidating after Friday’s 2% pullback, bulls to remain in play while $4200/$4162 supports hold

Gold holds within a narrow consolidation on Monday following almost 2% pullback from new record high ($4380) on Friday, driven by surprise comments from President Trump that the latest tariffs on China’s imports won’t be sustainable.

Reconciliating tones after a tough rhetoric during the past week, eased bullish pressure and sparked a partial profit taking, which resulted in the biggest daily loss since Nov 25.

However, Friday’s action closed well above $4200, significant support (the first lower breakpoint), keeping overall firm bullish structure intact and signaling that Friday’s drop, although quite significant, would mark positioning for fresh push higher.

The notion is supported by the fact that Trump’s comment should be viewed as isolated case (I was expecting him to soften his stance, as idea of adding 100% on existing tariffs would probably cause the equal damage to the US economy) as Trump aimed to threaten China over mounting problem with exports of rare earth metals, rather than imposing new taxes.

The factors that underpin safe haven demand remain unchanged, with the latest protest in the US, threatening to further destabilize already fragile political situation adding to high global uncertainty.

On the other hand, technical picture on daily chart weakens, as stochastic emerged from overbought territory, 14-d momentum is heading south and daily Tenkan / Kijun-sen turned sideways.

This warns that correction might not be over yet, but the price may hold in extended consolidation rather than attempting to dip further.

Holding above $4200 to keep bias with bulls and guard next trigger at $4162 (daily Tenkan-sen) violation of which would put bulls on hold and open way for deeper correction.

Res: 4300; 4330; 4380; 4400

Sup: 4219; 4200; 4162; 4131