Gold is trading in a narrow range but holds firm tone ahead of release of key US PCE inflation report

Gold keeps firm tone and holding near new all-time high on Friday, awaiting release of US PCE data (due later today) for fresh signals.

The metal remains well supported by strong demand (as safe haven as well as large purchases by central banks), geopolitical tensions and strong expectations for Fed’s first rate cut in September.

The yellow metal gained around 22% since the beginning of the year and is on track to register another monthly gain, in extension of steep rally in past six months.

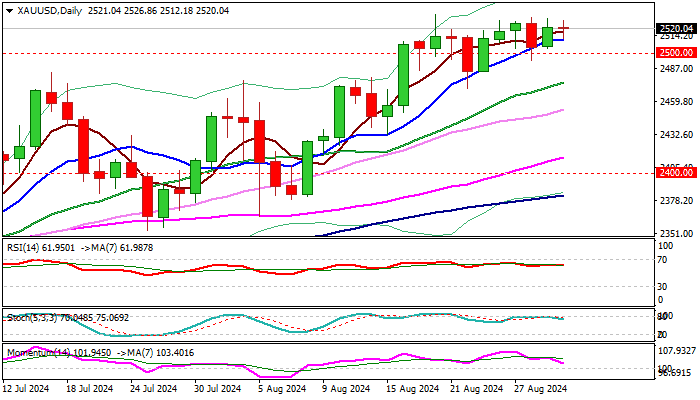

The latest triangular consolidation under new record high ($2531) is bullishly aligned, as dips were contained by rising 10DMA, with series of higher lows (tracked by 10DMA) pointing to still strong bids.

US Federal Reserve’s policy decision will be gold’s key driver in the near term with markets fully pricing for 25 basis points rate cut in September, but with growing bets that the central bank may opt for more aggressive action (50 basis points cut).

Today’s release of US PCE Index, Fed’s preferred inflation gauge, will shed more light on key points – the size and pace of policy easing.

The Core PCE Index (fine-tuned indicator, stripped by volatile components) is expected to remain unchanged (0.2%) month on month and annualized figure to tick higher to 2.7% in July from 2.6% in June.

Forecasts signal that values remain within required parameters which signal that inflation in the US stays under control and further opens the door for the central bank’s widely expected rate cut.

Gold would rise further if PCE data came mainly in line with expectations but may come under fresh pressure in case of hotter than expected July PCE numbers.

Bullish scenario sees gold price rising through current peak at $2531 and focusing targets at $2551 and $2574 (Fibo projections).

On the other hand, stronger unexpected inflation rise would deflate metal’s price with loss of initial supports at $2511/00 (10DMA / psychological) to risk deeper drop and test of pivotal supports at $2475/70 (20DMA / Aug 22 trough) and $2432 (Aug 15 higher low in extension.

Traders are also looking for next week’s key economic data (release August report from the US labor sector).

Res: 2531; 2551; 2574; 2600

Sup: 2511; 2500; 2470; 2452