Gold jumps from $2200 to $2300 in just four days, overextend studies warn of correction

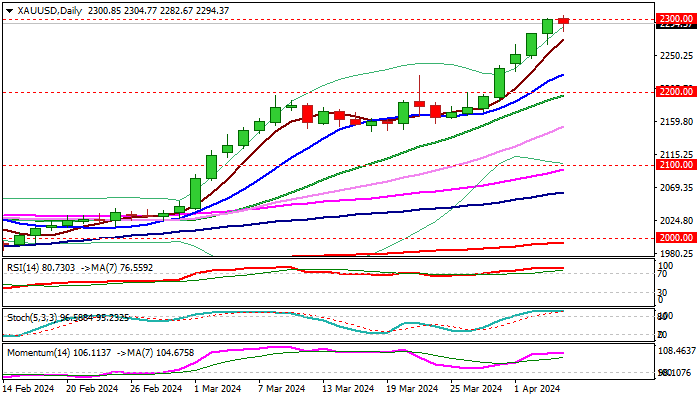

Gold hit new record high on Thursday on brief probe above psychological $2300 barrier and recorded the fastest rise from one to the other round-figure level, travelling only four days from $2200 to $2300.

The metal remains well supported by weaker dollar on dovish Fed, which is likely going to deliver its first rate cut in June, as well as growing geopolitical tensions.

Firm break of $2300 pivot would spark fresh acceleration higher and expose immediate targets at $2351 / $2400 (Fibo 161.8% projection of the uptrend from $1614 / psychological).

Meanwhile, bulls may take a breather on strong reversal signals, as studies are overbought on daily / weekly / monthly chart and the price rose above the upper 20-d Bollinger band on all these timeframes, which may spark profit-taking.

Overall technical structure and sentiment remain bullish and limited pullback should ideally find firm ground at $2225 zone (rising 10DMA) to mark a healthy correction and positioning for fresh push higher

Res: 2304; 2351; 2400; 2426

Sup: 2264; 2242; 2225; 2200