GOLD – larger bulls remain intact as post-Fed quick pullback stalls well above initial supports

Gold regained traction on Thursday and bounced around $40, after pullback from new record high ($3707) found footstep at $3730 zone.

Gold initially spiked above $3700 after FOMC announcement but reversed quickly after comments from Fed chief Powell proved to be less dovish that markets anticipated.

The US central bank cut interest rates by 25 basis points as widely expected and signaled another 0.5% cuts by the end of the year, but projections for the next year showed more cautious approach, as Fed expressed renewed concerns about inflation.

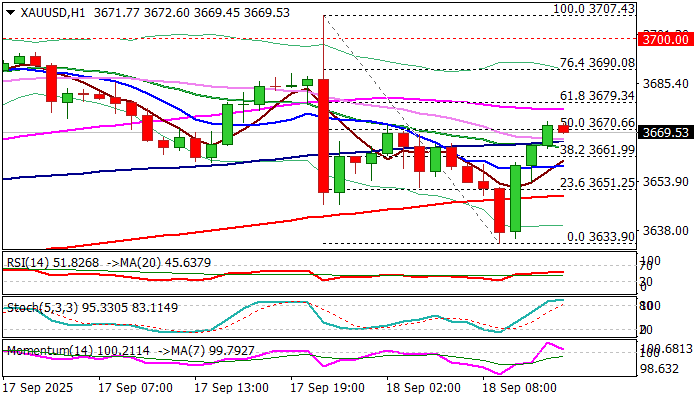

The latest pullback was deep enough to mark a sort of healthy correction, but also shallow enough not to harm larger bulls, as dips were contained by rising daily Tenkan-sen and stalled well above significant supports at $3614/00 (Fibo 23.6% of $3311/$3707 / psychological).

Subsequent bounce has so far retraced over 50% of $3707/$3633 pullback that brightens near-term outlook on signals that corrective phase might be over, and shifts focus to the upside.

Bulls eye next targets at $3677/79 (55DMA / Fibo 61.8%) and $3690 (Fibo 76.4%) the last obstacle en-route to key $3700 zone.

Daily studies remain in full bullish configuration and support the action, though some price adjustments should be expected due to overbought conditions on hourly chart.

Res: 3673; 3680; 3690; 3700

Sup: 3663; 3658; 3650; 3643