GOLD hits two-week high on renewed safe haven demand

Gold regained traction on Friday and rose about 1.7% for the day, to hit two-week high ($3365) and being on track for the biggest weekly gain since early April.

The metal shined on growing concerns over worsening US fiscal situation and warning from top US bankers that the economy is likely to enter stagflation, while. further weakening of the US dollar also contributed to fresh demand.

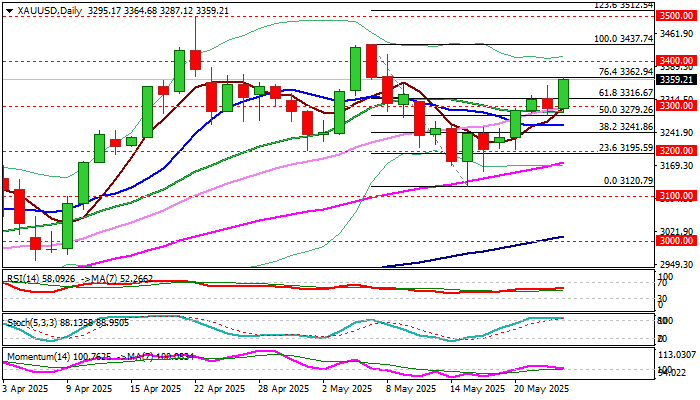

Friday’s rally hit Fibo 76.4% retracement of $3437/$3120 bear-leg ($3362) with weekly close well above former significant barriers at $3300/16 (psychological / Fibo 61.8% retracement) to strengthen near-term structure.

However, overbought stochastic on daily chart generates initial warning that bulls may face headwinds and slow the pace of climb.

Potential dips are likely to be shallow, as overall situation points to prolonged support to safe haven demand, with $3116 (reverted to support) to contain downticks and guard lower trigger at $3300.

Res: 3362; 3400; 3414; 3437

Sup: 3345; 3316; 3300; 3279