Gold may rally further after US CPI data boosted bets for September Fed rate cut

Gold price eases from new seven-week high on Friday morning, as traders took some profits from Thursday’s 1.9% post-US CPI data rally.

The yellow metal received fresh boost from cooler than expected US inflation, which boosted bets (93% from 70% before the data) for Fed rate cut in September.

Easing consumer prices was probably the signal that US policymakers were waiting for, as Fed Chair Powell said in his latest comments that the central bank is on rate cut path but needs more evidence before making a final decision.

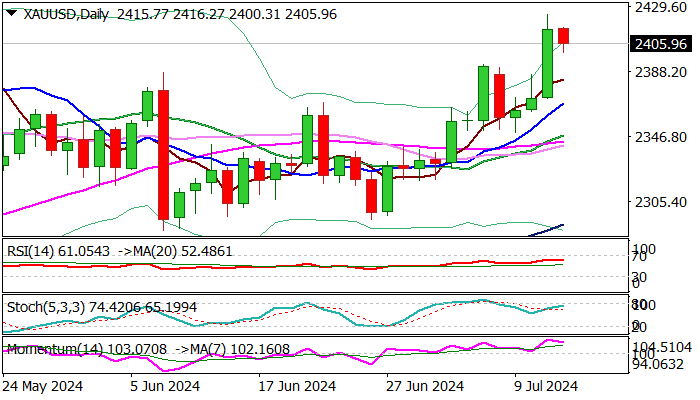

Gold price moved to the upper side of broader range under new all-time high, with improving fundamentals (falling inflation and weak economic data, as well as deteriorating geopolitical situation) and bullish technical studies, supporting scenario of fresh acceleration through $2450 barrier and rally into uncharted territory, with initial target at $2500 expected to come in focus.

Corrective dips should be ideally contained at $2380 zone and not exceed daily Tenkan-sen ($2371) to keep bulls in play and offer better buying opportunities.

Res: 2424; 2433; 2450; 2500

Sup: 2392; 2380; 2371; 2355