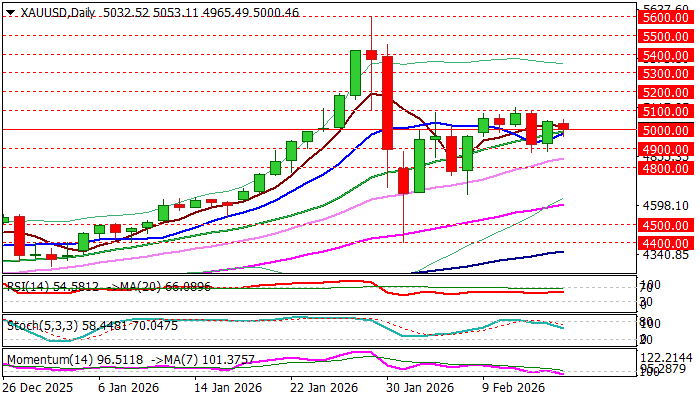

GOLD – near-term action remains in directionless mode within $4900/$5100 range

Gold price edged lower in early Monday but held within a narrow range, due to lower volumes, as Far East and the US markets are closed for holidays.

The yellow metal traded within $4900/$5100 range in the past few sessions, reflecting lack of direction, as key drivers sent mixed signals lately.

Technical studies show conflicting signals from negative momentum and bullish setup of MAs, while the latest economic data from the US were also mixed (unexpected strengthening in the labor market / slower than expected rise in consumer prices).

Situation on geopolitical front is also unclear after immediate threat of US-Iran conflict eased and two countries started negotiations, although the situation remains fragile (Ukraine / deepening political gap between the US and EU) that may keep safe haven demand in the upward trajectory.

Markets wait for fresh signals that would define near-term direction, with key technical levels standing at $4900 zone and $5100 zone.

Break of either side to generate initial signal of reversal or bullish continuation.

Res: 5053; 5100; 5118; 5200

Sup: 4980; 4900; 4880; 4850