Gold – near term tone firmed ahead of key event – Powell’s speech in Jackson Hole

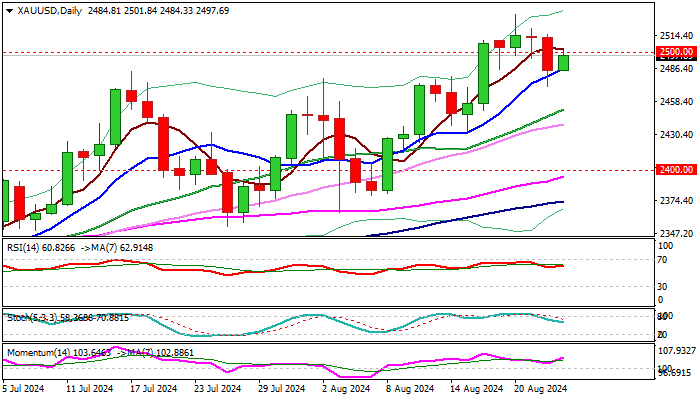

Gold regained traction and bounced on Friday, reversing so far around a half on Thursday’s 1.1% drop, which broke and closed below psychological $2500 level.

Top of the former range at $2480 zone performed as solid support and contained dip, which also closed above rising 10DMA, adding to idea that deeper pullback was just positioning for fresh push higher.

Fresh gains cracked $2500, with daily close above to signal that bulls regained full control after a short-lived dip.

Daily studies are in full bullish setup and contribute to overall bullish picture, as the yellow metal recently hit a series of new record highs, boosted by growing expectations that the Fed will start cutting interest rates from September, geopolitical tensions and uncertainty over the US economic outlook.

All eyes are on Fed Chair Powell, who will deliver the speech in Jackson Hole symposium of central bankers later today, with wide expectations that he will confirm signals for September rate cut and provide more details about the depth and pace of policy tightening.

Dovish narrative, in line or above expectations to likely offer fresh boost to the metal and push price again into uncharted territory.

Violation of fresh all time high ($2531) to expose projections at $2547, $2564 and $2590).

On the other hand, any surprise from Powell, which cannot be completely ruled out as the Fed needs to consider several key factors (the timing and size of rate cut or no rate cut this time, consequences of each decision on the economy which is highly vulnerable and my slow further in an inappropriate and not finely balanced Fed decision) before making the final cut.

Gold price would come under fresh pressure in such scenario and probably enter deeper correction.

Res: 2509; 2519; 2531; 2547

Sup: 2486; 2480; 2470; 2451