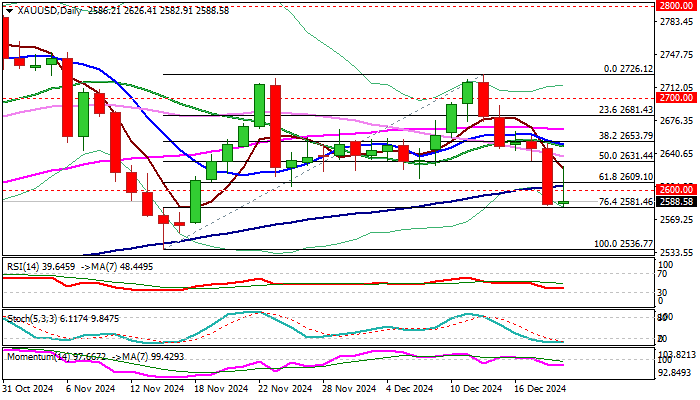

Gold – post-Fed weakness likely to extend after recovery stall

Gold bounced from new one-month low ($2582), hit on post-Fed 2.3% drop on Wednesday, but gains were so far short-lived.

Recovery stalled at $2626, with subsequent acceleration lower pushed the price again below important (broken) supports at $2605/00 (100DMA / psychological).

Wednesday’s close below these levels generated initial bearish signal, which will be validated on repeated daily close below, with long upper shadow of Thursday’s daily candle, signaling that offers remain strong.

However, temporary base that has formed at $2581 (lows of Wed/Thu / Fibo 76.4% of $2536/$2726) marks solid support which may hold for some time.

Bearish technical studies on daily chart contribute to Gold-negative fundamentals (Fed’s hawkish cut and signals of slower pace of rate cuts in 2025 strongly inflated dollar) and keep near-term risk shifted to the downside.

Immediate bias to remain with bears while the price stays below $2600/05), with stronger upticks to be capped under daily Ichimoku cloud base, reinforced by Kijun-sen ($2631).

Res: 2600; 2605; 2631; 2650

Sup: 2581; 2564; 2536; 2511