Gold price falls further as US-China trade deal fuels risk appetite

Gold price fell through key supports on Wednesday, deflated by growing optimism on US-China trade deal that cooled fears about deeper economic crisis and offset other factors that boost safe haven demand.

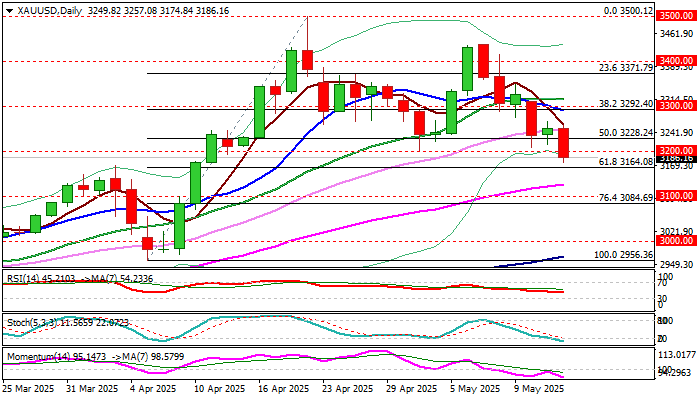

Fresh wave of risk appetite pushed gold through pivots at $3228 (50% retracement of $2956/$3500 upleg) which recently contained several attacks and $3200 (psychological / low of pullback from new record high).

Sustained break of $3200 to complete bearish failure swing pattern and generate signal of potential deeper pullback from $3500 peak.

Daily studies are weakening as 14-d momentum is heading deeper into negative territory and the price fell below 10/20/30 DMA’s which also formed bear-crosses.

However, oversold stochastic warns of possible increased headwinds that may result in hesitation at $3200 zone and keep near term price action in extended consolidation.

The price should stay under broken Fibo 50% ($3228) and extended upticks not to exceed daily highs of Tuesday / today ($3265/57 respectively) to keep bears intact.

Res: 3200; 3228; 3265; 3292

Sup: 3164; 3126; 3100; 3084