Gold price rises on revived rate cut expectations; US inflation data in focus

Gold price rose on Wednesday, lifted by the latest comments from Fed Chair Powell, which warmed up expectations rate cut, after the central bank postponed the start of policy easing several times.

Powell’s testimony on Tuesday provided fresh hints that the central bank remains on track for rate cut, following recent weak US economic data, though the policymakers remain cautious and still require more evidence to finally give a green light

Market bets for rate cut in September rose to 75%, with growing expectations for another easing in December, though the final decision will be in hands of the US policymakers, with Powell’s second day of testimony today and release of US June CPI report, to provide more clues about the timing of Fed’s action in coming months.

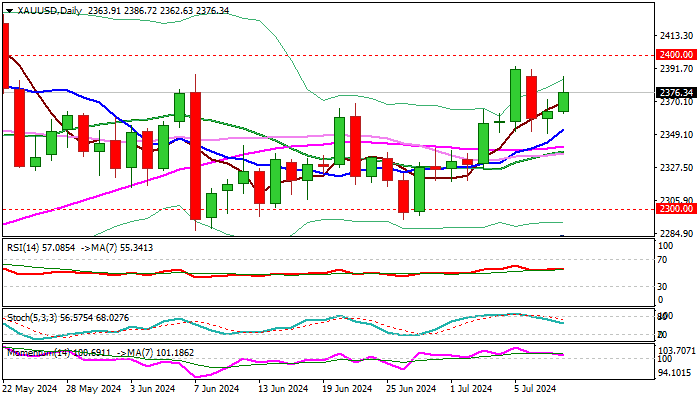

Fresh strength pushed the price to the upper side of longer range, spanned between $2390 and $2290, with psychological $2400 coming in focus.

Daily studies are bullish, but positive momentum is fading, with fundamentals likely to play a key role again.

US annualized inflation is expected to ease to 3.1% in June from3.3% in May, while core inflation, stripped for the most volatile components is expected to remain unchanged at 3.4%.

Gold will benefit if consumer prices diverge from consensus to the downside, as such scenario would move the Fed one step closer to the first rate cut and probably push the price above $2400 pivot.

Conversely, higher than expected Jun CPI numbers would sour metal’s sentiment.

Res: 2392; 2400; 2433; 2450

Sup: 2362; 2351; 2341; 2319