Gold price tumbles as waves of fresh optimism fade safe-haven demand

Gold price fell around 2.5% at the start of the week, as positive news (US-China trade deal / India – Pakistan ceasefire) dominated in early Monday and strongly contributed to fading safe haven demand.

Fresh optimism that disastrous scenario of escalation of trade war between world’s two largest economies has been avoided, lifted US dollar and pushed metal’s price to the lowest in almost two weeks.

All eyes are now on potential direct peace talks between Russia and Ukraine, with any signs of progress to further deflate gold price.

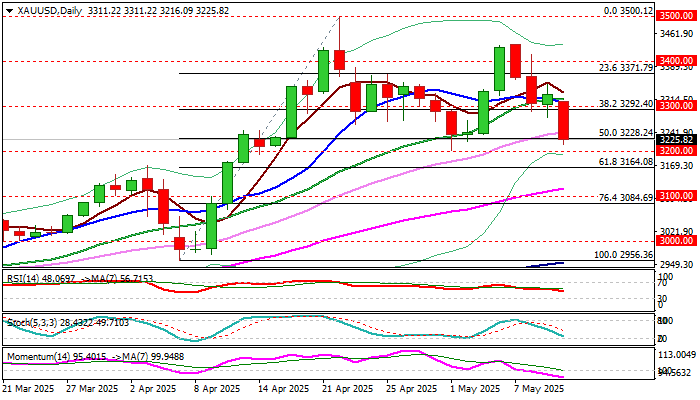

Positive signal on clear break of pivotal $3300 support zone (psychological / Fibo 38.2% of $2956/3500 upleg) weakened near-term structure, as negative momentum strengthened further and 10/20DMA’s formed bear cross.

Bears cracked next significant support at $3228 (Fibo 50% / daily Kijun-sen) and eye breakpoint at $3200 (floor of consolidation range under new record high), break of which to complete a failure swing pattern on daily chart and generate stronger reversal signal.

However, headwinds at $3200 zone can be expected, due to significance of support, with limited upticks likely to mark positioning for fresh acceleration of pullback from $3500 (new record high), if current factors that drive gold price persist.

Broken $3292/$3300 supports reverted to solid barriers which should cap potential stronger upticks and keep bears in play.

Break of $3200 trigger to unmask targets at $3164 (Fibo 61.8%), $3100 (round-figure) and $3084 (Fibo 76.4% of $2956/$3500).

Res: 3242; 3265; 3292; 3310

Sup: 3200; 3164; 3116; 3100