Gold probes again through key supports as trade tensions ease

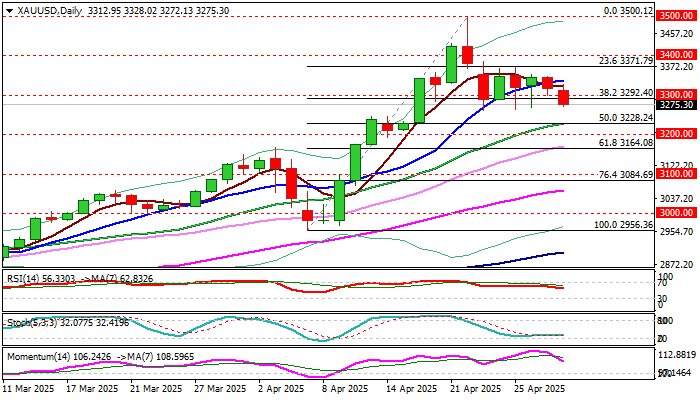

Gold price holds in red for the second consecutive day and probes again through key $3300/$3292 zone (psychological / Fibo 38.2% of $2956/$3500 rally), where several recent attacks failed.

The risk sentiment has weakened again on growing signs of de-escalation of US – China trade conflict (although still looking for confirmation that two sides are on the firm way to reach a final deal and ease tensions).

However, larger picture is unclear as many fear of strong negative impact on global economy from tariff war that continues to fuel safe haven demand, against hopes that two largest economies are on the right track to avoid disastrous scenario that would continue do deflate metal’s safe haven appeal.

Based on these theories, we can conclude that near-term action faces two strong and opposite forces, which could keep the price in extended consolidation, before establishing in fresh direction.

Triggers remain unchanged, with loss of $3300/$3292 to generate initial but strong negative signal, which will look for confirmation on extension below $3228 (50% retracement / 20DMA).

Alternatively, lift above 10DMA ($3337) to initially ease immediate downside risk, with extension above upper pivots at $3371 and $3400 (recent range tops / broken Fibo 23.6% / psychological) to indicate an end of corrective phase and formation of higher base.

Markets will look for more signals from US economic data (GDP, PCE, NFP) due this week.

Res: 3292; 3300; 3328; 3336

Sup: 3260; 3245; 3228; 3200