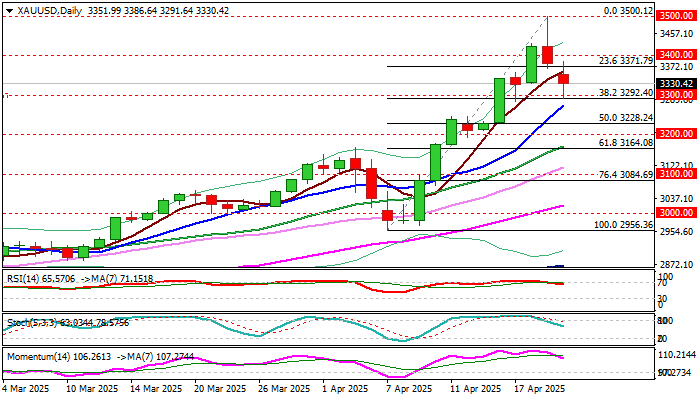

Gold – reaction at $3300 support zone to generate near-term direction signal

Gold remains in red for the second straight day and hit support at $3300 in early Wednesday, in extension of quick pullback from new record high at $3500, posted on Tuesday.

Significance of $3500 level which many analysts saw as 2025 target and strongly overbought daily studies contributed to profit-taking that pushed the price around $200 in past 24 hours.

Significant change in President Trump’s rhetoric over tariffs on China’s imports, in which he greatly eased tensions by signaling much lower tariffs, as well as comment that there was no plan to fire Fed Chair Powell, resulted in fresh pressure on gold price.

Pullback from new all-time high so far found a solid ground at $3300 zone (psychological / Fibo 38.2% of $2956/$3500 upleg / rising daily Tenkan-sen) with subsequent bounce suggesting that near-term bears might be running out of steam.

Daily close above 3300 would generate an initial signal of a healthy correction, which was to provide better levels to re-enter larger bullish market.

However, this scenario still needs confirmation, with minimum requirement seen on daily close above broken Fibo 23.6% ($3371) and return and close above $3400.

On the other hand, daily RSI emerged from overbought territory, 14-d momentum is heading south, and both indicators show more space at the downside that keeps in play risk of further easing.

Key factors that will influence gold’s direction in the near term will be the magnitude of change in market sentiment over Trump’s latest much softer and reconciliating tone.

On the other hand, persisting geopolitical tensions and growing concerns over predominantly negative economic outlook (IMF slashed its outlook for US and global growth, although denied immediate threats of recession for the US) are expected to continue to fuel safe haven demand.

From that perspective, gold price is likely to resume its rally after a brief pause, with firm break of $3500 to open the door towards $4000, which many already see as next target.

Levels to be watched below $3300 are $3228 and $3200, while upper pivots lay at $3371 and $3400, guarding $3430 and $3500.

Res: 3371; 3400; 3430; 3500

Sup: 3300; 3285; 3228; 3200