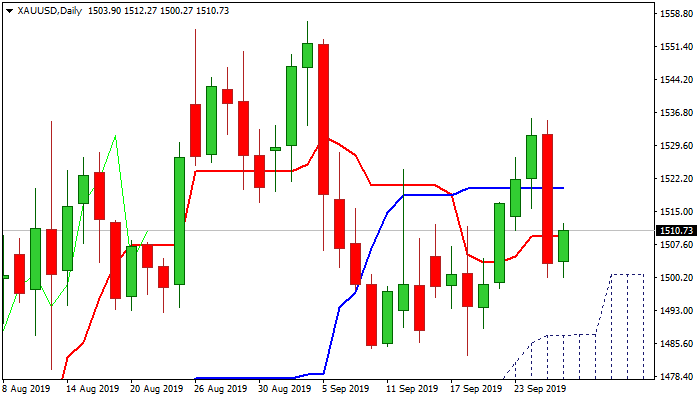

Gold recovers after strong fall but pivotal barriers stay intact for now

Spot gold bounces from $1500 level which contained Wednesday’s 1.9% fall.

The yellow metal fell sharply on renewed risk appetite that prompted traders to collect profits from four-day $1483/$1535 rally.

Wednesday’s fall (the second biggest one-day loss in Sep) found footstep at psychological $1500 support and managed to close just above cracked Fibo support at $1503 (61.8% retracement of $1483/$1535 upleg), keeping alive hopes of fresh upside attempts.

Double rejection at $1500 (Wed / Thu) and rising daily cloud that continues to underpin the advance since early June, support the notion, along with rising daily momentum which is attempting to break into positive territory.

Recovery needs extension and close above $1513 pivot (30DMA / Fibo 38.2% of $1535/$1500 descend) to signal higher base formation at $1500 and reversal.

Caution on loss of $1500 handle that would risk dip towards daily cloud top ($1487).

Res: 1513; 1518; 1522; 1527

Sup: 1506; 1500; 1487; 1483