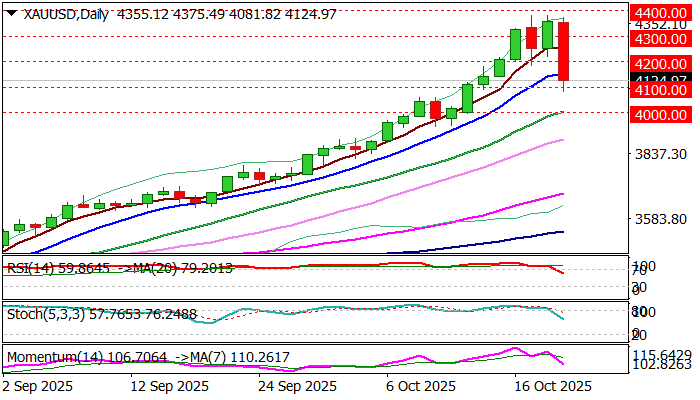

GOLD registers the biggest daily loss in five years as pullback accelerated after violating key supports

Gold price collapsed on Tuesday, falling around 6% in the biggest daily drop since 2020, after hitting a series of new record highs in past few sessions.

Correction was not a surprise as daily studies were strongly overbought for some time and the price was capped just under new record high in past few sessions, pointing to corrective action.

Most market observers expected limited action which would be just positioning for fresh push higher, as none of key factors that have driven gold price sharply higher, haven’t registered any significant change.

Solid supports at $4200/$4160 (psychological / daily Tenkan-sen) were expected to hold dips and keep larger bulls intact, however, violation of these supports sparked stronger sell-off, sidelining initial and ideal correction scenario.

Extended dips found firm ground at $4100 so far, with today’s close above this level, to bring some optimism.

On the other hand, large bearish daily candle is expected to weigh, with daily indicators in steep descend but with plenty of space at the downside, suggesting that correction might not be over.

Loss of $4100 handle would expose the breakpoint at $4000 and risk deeper correction if this support is broken.

Alternatively, ability to hold above $4100 would revive some optimism, but lift and sustained break of $4200 barrier will be needed to sideline bears.

Res: 4160; 4200; 4186; 4219

Sup: 4100; 4059; 4000; 3947