Gold retests $2200 barrier on renewed safe-haven demand

Gold price jumped on Tuesday and retested psychological $2200 barrier, inflated by weaker dollar on improved sentiment about Fed rate cuts and persisting geopolitical risks.

Market awaits release of US inflation data, due later this week, which could bring fresh hints about timing of the start of rate cuts.

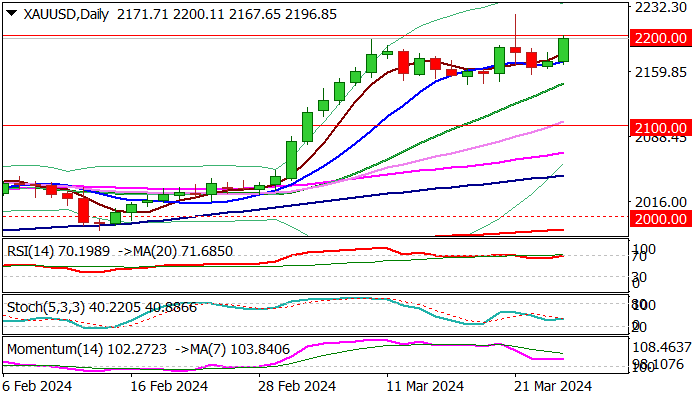

Fresh strength attacks the ceiling of the recent range, after a short-lived spike to new all-time high last week.

Bullish technical picture on daily chart contributes to positive sentiment and underpins the action.

Sustained break above $2200 to generate fresh bullish signal for retest of new top ($2222), violation of which to signal continuation of a larger uptrend and expose targets at $2250 (Fibo 138.2% projection of the uptrend from 2022 low at $1614) and $2300 (psychological).

Near-term bias is expected to remain firmly with bulls while the price action stays above 10DMA ($2171).

Res: 2200; 2222; 2250; 2300

Sup: 2184; 2170; 2146; 2131