Gold rises above $1800 on weaker dollar, inflation risk

Spot gold extends advance for the third consecutive day and is on track for the first positive weekly close after being in red for past four weeks.

The yellow metal gained support weaker dollar and also benefited from rising inflationary pressures as it is usually used as a hedge against inflation.

Friday’s extension of post-Fed’s 1.2% rally is establishing above $1800 level and on course for the first daily close above this point since Nov 22.

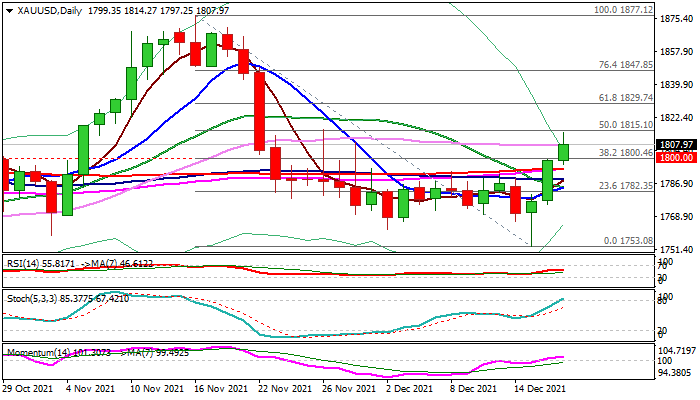

Bulls also probed above rising and thickening daily cloud, close above which would boost a bullish stance and strengthen the reversal signal that is forming on a weekly chart (long-tailed bullish candle forming after a double-Doji, north-heading 14-period momentum emerged into positive territory and price action moved above converging WMA’s).

Daily techs also improved significantly after the price broke above two-week range and strong barriers at $1794/$1800 (converged 55/200DMA’s / psychological) which reverted to solid supports.

Near-term bias is expected to remain positive while the price action stays above $1800 mark, with sustained break of cloud top ($1811) and pivotal Fibo level at $1815 (50% retracement of $1877/$1753) to confirm reversal and unmask targets at $1829/47.

Res: 1811; 1815; 1829; 1847

Sup: 1800; 1794; 1788; 1782