Gold – rising global uncertainty continues to push gold price to new record highs

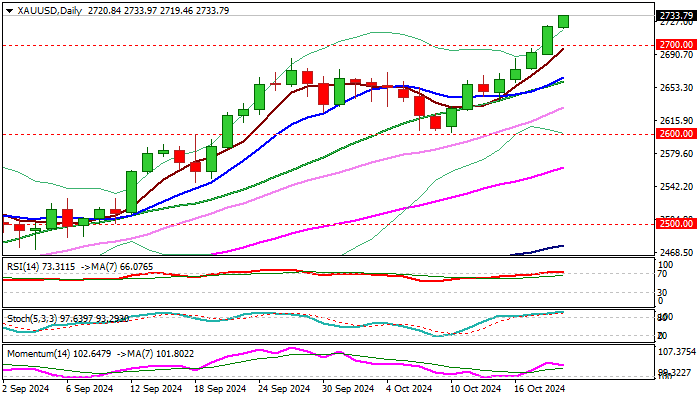

Gold continues to trend higher and hit new record highs on Monday morning, after last week’s close above psychological $2700 barrier generate fresh positive signal and reinforced bullish stance.

The yellow metal continues to benefit from increased safe-haven demand on growing uncertainty surrounding US election and easing monetary policy by major central banks, with persisting fears of escalation of geopolitical situation, particularly in the Middle East, add support to bullion price.

Significant rise of gold price in 2024 (gold was up over 32% since January) contributes to very bullish outlook, as the price action is mainly driven by fundamentals.

Overbought conditions on all larger timeframes, which warn of corrective action, were so far ignored, though limited corrective easing cannot be ruled out in the near future.

Broken $2700 barrier reverted to initial support, followed by former top at $2685, with rising 10DMA ($2664) to ideally contain dips and keep larger bulls intact.

Res: 2736; 2748; 2768; 2800

Sup: 2719; 2700; 2685; 2664