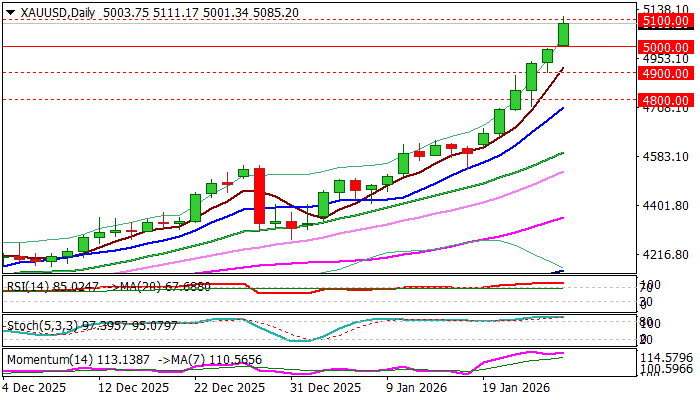

Gold surges through key $5000 barrier and cracks $5100 as uncertainty rises

Gold took out $5000 barrier in one single step on Monday, in a widely expected post-weekend action, but made a small surprise to traders by extension to $5100, which happened in just few hours of early Monday’s trading.

The yellow metal started trading with a gap higher and opened slightly above $5K following news over the weekend that added to strong bullish stance.

Growing signals about potential US attack on Iran contributed to strong migration into safety, also fueled by overall geopolitical situation being close to boiling point, weakening economic outlook with signs of deeper crisis on horizon, growing political and economic tensions between the US and EU (Greenland, tariffs) deteriorating situation in Ukraine (no big hopes from current peace talks), fragile situation in the Middle East region and strong demand for gold from investors and central banks.

This leaves very little space for any significant correction despite strongly overbought studies (daily / weekly / monthly) as traders do not dare to take profits on rallying market.

Overall picture remains firmly bullish from both technical and fundamental aspects, though fundamentals remain key driver, suggesting that the price could rise much more if current conditions deteriorate or at least stay unchanged.

Today’s close above $5000 is a minimum requirement to keep bulls intact for further advance, with clear break of $5100 to confirm bullish continuation.

The price is riding on an extended third wave of five-wave cycle from $3997 (Nov 18 higher low), with cracked round figure $5100 and session high / new all-time high at $5111, marking immediate resistances, followed by $5172 (Fibo 161.8% expansion), $5200 (round-figure) and $5253 (Fibo 176.4% expansion).

Minor support lays at $5050 (intraday low) followed by $5039 (20HMA) and the most significant psychological $5000 level (broken key resistance, reverted to strong support, also daily low) where extended dips should find firm ground.

Current structure favors very limited profit taking, with limited dips to mark consolidation and positioning for further upside.

Res: 5111; 5172; 5200; 5253

Sup: 5040; 5000; 4965; 4937