GOLD – the downside remains vulnerable after bears cracked critical $4000 support

Gold remains in roller coaster mode, as a lot of action has been seen since late last night’s update, with all options still being on the table.

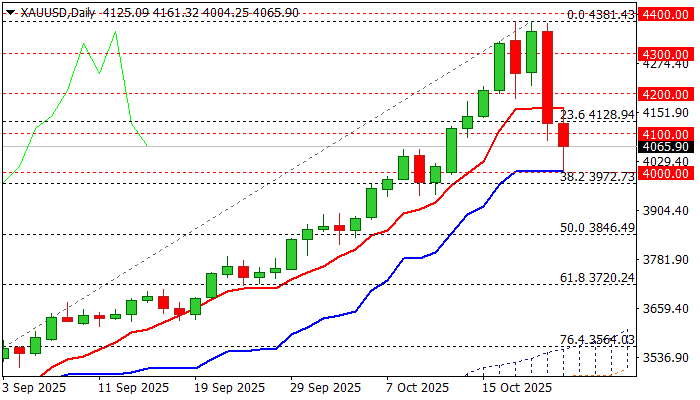

Slight optimism was sparked after Tuesday’s closing above $4100, though subsequent gains failed to fulfill the minimum requirement, as recovery attempts were capped by initial barrier – daily Tenkan-sen ($4164) that kept the upper breakpoint at $4200 out of reach and left the downside vulnerable.

Overnight’s action showed dominating negative sentiment as the price fell further and tested critical support at $4000 (psychological, reinforced by daily Kijun-sen and nearby Fibo 38.2% retracement of $3311/$4381 rally), but quick bounce showed the significance of this support.

Near-term action continues to move within a wider swings around $4100 level, pointing to indecision, but also signaling that key support at $4000 remains at increased risk.

Bearish hourly studies (negative momentum / 30/200HMA bear cross) support negative scenario, but larger bullish structure remains intact (the latest pullback was the biggest correction since 2022), adding to scenario of re-entering fresh longs if $4000 holds and once we see bullish signal.

Caution on break of $4000 as this may lead to deeper correction and expose supports at $3900 / $3850 and put larger bulls on hold.

Fundamental picture remains mainly unchanged, with focus on Trump Xi meeting which is expected to ease trade tensions between two largest world economies and probably produce some negative impact on safe-haven demand.

Markets also await release of delayed US inflation report (due on Friday) which would provide more details to Fed ahead of their next week’s policy meeting as investors widely expect the central bank to deliver two rate cuts by the end of the year.

Res: 4128; 4167; 4200; 4225

Sup: 4000; 3972; 3900; 3850