How to Start Day Trading in 2026: A Complete Beginner Guide

Global markets are brimming with day-to-day trading opportunities holding solid earning potential for those who follow trends around the clock and act fast. If you are looking to capitalize on daily price shifts, day trading could be the way to go. You are probably wondering – what is day trading? It’s a fast-paced trading method relying on technical analysis, chart patterns, quick decisions and deep knowledge of the markets.

Day traders hold positions open from seconds to hours, but never overnight. They rapidly buy and sell assets within a single trading day aiming to seize gains from daily market volatility. They take advantage of small price movements in highly liquid markets which can open the door to promising results. Here is your all-in-one, step-by-step guide on how to get started with day trading. Discover all you need to know, from the basics to taking the first steps, to mastering effective strategies.

Why CFDs are the no.1 options for day traders

CFDs are the go-to choices for day trading, for multiple reasons. They offer leveraged exposure, higher flexibility, faster execution, greater strategic control, seamless diversification – all essential features for the high-speed dynamic this particular trading style relies on.

- Day traders tend to choose CFDs as they allow them to:

- Manage larger positions with smaller capital using leverage

- Maximize potential returns on small price changes with leverage

- Open long and short positions to gain both from rising and falling markets

- Diversify with a wide range of global assets available through a single account

- Manage risk better with automation features like stop-loss and take-profit orders

- Benefit from swift execution which makes opening and closing trades faster

Understanding the Basics

It’s vital that you have a tight grasp of fundamental concepts before tapping into CFD investing. Understanding how everything works unlocks access to infinite possibilities, higher chances of financial success, and boosts your confidence in the new mission you are undertaking.

Let’s have a closer look at some common trading-related questions and delve deeper into the subject.

What are CFDs?

CFD trading is a flexible alternative to conventional investing which involves buying, holding and selling an asset. With Contracts for Difference (CFDs), you can speculate on price movements without owning the underlying asset whether it’s currencies, stock, indices, metals, commodities and more. This major advantage is a game changer if you are looking to react fast to shifting price action.

When trading CFDs, you enter an “agreement” with a broker to exchange the difference in the value of an asset from when you opened a trade until you closed it. You can open a long trade (position) if you think the price of an asset will climb higher, or a short trade (position) if you believe the price will go lower. This gives you the flexibility to trade in both directions and generate profit from both bull and bear markets.

For example, a trader opens a short position on a stock at $50 dollars. If the price drops to $40 and they close the position, they will gain the $10 difference– multiplied by their contract size and leverage option – as their profit. However, if the market moves in the opposite direction and the price rises, they incur a loss of the same size.

What is leverage in trading?

Leverage is a key feature in CFD trading that enables you to open a larger trade with a smaller initial cost. In other words, it makes trading more accessible by giving you the chance to trade more than what your capital would normally allow you to.

It can become a powerful tool in the hands of a knowledgeable trader. It can increase potential returns but at the same time it can magnify losses. That is why disciplined risk management is advised when using this feature.

Leverage is expressed as a ratio. For example, if you trade with a leverage of 1:100, you can open a position worth $100,000 with only $1,000 in margin. This enables you to gain greater exposure in the markets, make the most of your capital, and multiply your potential gains, especially when day trading and looking to take full advantage of short-term market movements.

What is margin in trading?

Margin is the minimum account balance necessary to open and keep a leveraged position open. That includes initial margin, the amount required to open a trade, and maintenance margin, the amount necessary to keep the trade open. It’s essentially the collateral a trader needs to have in their account to cover potential losses.

If market conditions turn against your trade and the account equity drops below maintenance level, a margin call can occur. In this case, you can deposit more funds to keep the position open or risk having your trade closed to limit ongoing losses.

How to manage risk in trading?

Effective risk management while trading any asset is essential. There are multiple ways to manage potential losses, protect your trading capital and safeguard its long-term earning potential.

Some of these include built-in MT4 and MT5 tools like:

Stop-loss orders – that close a position automatically at a certain price to limit losses

Take-profit orders – that close a winning position at a certain price to secure profits

Having a solid trading plan, managing leverage with caution, keeping emotions under control, diversifying your investment portfolio and being mindful of position sizing can also help you control risk better while seizing opportunities in global markets.

Laying a Solid Foundation – Creating a Strategy

A trading strategy is a carefully crafted plan for opening and closing trades. It sets out rules and criteria determining when to buy and sell an asset. It can be simple or complex, adjusted to your goals and risk tolerance, based on technical or fundamental analysis or a combination of the two.

A plan like this acts as a guide for navigating the financial markets, helps manage risk and optimize decision-making. It removes emotions from trading and helps you focus on achieving your long-term goals.

Multiple steps are involved in the formation of a well-developed, customized trading strategy. Let’s go through them one by one.

Step 1. Choose a trading asset

When picking an instrument, you need to assess its volatility levels, as fast and large price swings can create opportunities and maximize returns. At the same time take into account that having a real interest in an asset will make it easier for you to trade it. For example, fast-car lovers could be well-suited to trading Ferrari or Tesla stocks, precious metal enthusiasts could enjoy trading gold or silver, etc.

Step 2. Identify goals and determine risk tolerance

“Why am I trading?”, “What’s my daily, weekly or monthly returns goals?”, “How much time can I spare every day?”, “How much money am I comfortable trading with?”, “How much risk am I ready to take on each trade?” – are questions you should be asking yourself at this point. Note down the answers. That will determine your trading style and help you have a clear view of your targets, committed funds and risk appetite from the get-go.

Step 3. Create the strategy

Now, it’s time to work on developing your strategy. This becomes the blueprint for your next moves in the markets.

Use a mix of signals: Study price action on chart patterns, use technical indicators and look into fundamental data to form your criteria.

Use multiple timeframes: Analyze the asset’s price movements across more than one chart intervals to identify an overall trend and time your positions.

Specify entry and exit points: Determine the exact levels at which you buy and sell.

Establish risk management rules: Adjust your position sizes and set stop-loss levels to limit risk.

Specify trade management: Consider whether you will be actively monitoring your trades and adjusting according to market conditions or whether you will set them up and let them develop.

Start with a Demo Account

Once you finalize your trading strategy, it is essential that you run tests to confirm its validity and refine it further if necessary. This will make you more confident in your next moves.

Backtesting is the first step towards checking whether you are headed in the right direction. What you do is test your trading strategy against historical datasets that are a close match to current prices, regulations and market conditions. Testing over a small sample could generate positive outcomes but testing over 1-2 years of data could highlight weaknesses. The results reveal how effective your strategy would have been in those past markets and help you identify what works well and what doesn’t. If results fail, you reset parameters or timeframes and test again until you achieve consistency.

Demo trading is the final test before committing your own capital. On a demo trading account, you test your trading strategy in live market conditions with virtual funds and zero financial risk. This allows you to check how your plan works in current markets, see whether you can stick to your risk management setup or stay within your capital limits. With Windsor Brokers’ demo accounts, you can validate the efficiency of your course of action with up to $50,000 in virtual funds.

Once your testing is completed and your strategy is optimized, you can start trading live.

Track Everything

A trading journal is a crucial component of a successful trading plan. You should use it to record every trade in detail. Except for technicalities like entry and exit points, you should also include the thoughts behind your every move. For example, if you diverge from your strategy, note down in detail why you decided to do it, the emotional state you were in, what happened afterwards and how it made you feel. Journaling can be a powerful tool that enables you to reflect on your technical and personal strengths and weaknesses. Go back to those detailed records, review your trades, evaluate your decisions, identify your successes, spot areas for improvement and fine-tune your strategy from time to time.

Choose the Right Broker & Live Account

Your trading broker is more than just your gateway to the financial markets; they are your online trading partner. That’s why choosing a trusted and reliable broker can make a world of a difference. Beyond a smooth trading experience and excellent trading conditions, you should be looking for safety and ongoing support through every market condition.

That’s why millions of investors around the world choose Windsor Brokers. With almost 40 years of experience, we have proved that we can stand the test of time to be offering a world-class trading experience up to this day. Our clients are our number one priority while security, transparency, innovation and dedicated customer support are at the center of what we do. Segregated trading accounts and up to $5,000,000 client insurance ensure you seize investment opportunities with peace of mind.

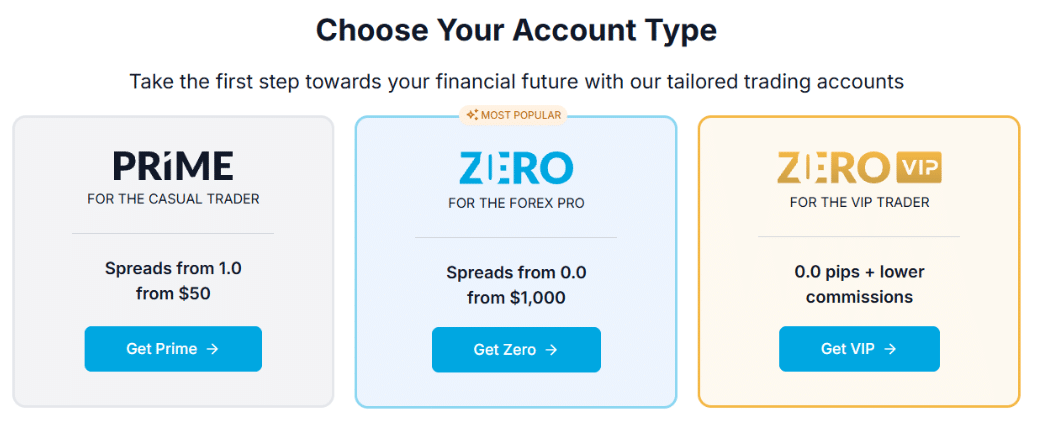

Choosing the live account that best fits your needs is another crucial step before kickstarting your trading journey. The right features and benefits can help you reach your financial goals. Our Windsor Brokers account types include our PRIME, ZERO and ZERO VIP options which open the door to hundreds of assets from global markets, trading costs starting from $0, dynamic leverage, expert insights, advanced trading tools, unlimited cash rewards and more award-winning conditions.

Go Deeper with Expert Education

The key to ongoing success in the financial markets is continuous learning and leveling up your skills. Upgrading your trading knowledge can help you enhance your decision-making ability, minimize risks, maximize potential and stay ahead of new trends and technologies.

Registering with Windsor Brokers, you automatically unlock unlimited access to hundreds of free trading education materials. Our live and pre-recorded webinars, step-by-step video courses and comprehensive eBooks make up an extensive library covering a wide array of topics, from expert insights to forex trading, market trends, risk management, trading psychology, the best forex trading strategies and much more.

Review, refine, and scale

In ever-evolving markets, strategies that worked in certain market conditions could stop being successful once dynamics shift. With time, your personal financial goals change, too. To keep your strategy aligned with changing economic environments and your ambitions, you need to regularly evaluate and optimize your parameters.

Once in a while, revisit your trading journal, go back to your recent entries, see what worked and what didn’t. At the same time, keep studying new trading techniques and stay on top of market developments. Use that information and knowledge as a guide to adjust your strategy. After your backtesting and demo account trading generate positive results, you can take your updated strategy live again.

The Bottom Line

As we have seen, day trading is a sophisticated investing method that requires technical skills, constant monitoring of the markets, a solid action plan and discipline. When met with fast decisions, a strategic approach is the best way to go. And having a reliable broker by your side is another excellent strategic move. Windsor Brokers can support you on your day trading journey, every step of the way. From expert education to advance your knowledge, to cutting-edge tools and platforms to enhance your decision-making and award-winning trading conditions to boost potential returns, you can stay well-positioned for success. Become one the millions of traders around the world who already trust Windsor Brokers with their online CFD trading, with just a click.