Limited recovery likely to precede bearish continuation

The Euro edges higher on Monday, following Friday’s drop that generated strong signal of recovery stall.

Fresh strength was fueled by weaker dollar and resisted negative news that French President Macron lost an absolute majority in the country’s parliamentary election, however prospects for stronger recovery are very low.

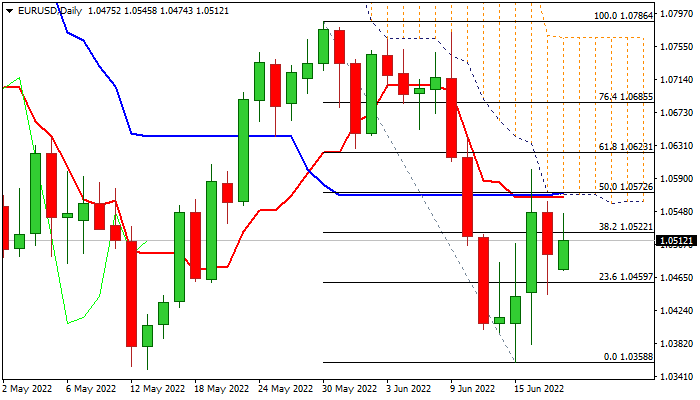

The action remains weighed by thick daily cloud which capped recovery attempts on Thursday and Friday, while 14-d momentum remains deeply in the negative territory and moving averages are in negative setup that supports scenario of limited recovery before larger bears resume.

Bias is expected to remain with bears while the action stays capped by the cloud base, with extended consolidation likely to precede fresh push lower.

Violation of recent lows at 1.0358/49 and more significant 2017 low (1.0340) would open way towards next key supports at 1.0069/1.0000 (Fibo 76.4% of 0.8225/1.6039 / psychological).

Caution on penetration into daily cloud (base is reinforced by converged Tenkan-sen and Kijun-sen) and lift above 1.0623 (Fibo 61.8% of 1.0786/1.0358) that would ease downside risk and allow for stronger correction, but only lift above 1.0786 (May 30 high) would neutralize bears on completion of a double-bottom pattern.

Res: 1.0537; 1.0572; 1.0589; 1.0623

Sup: 1.0459; 1.0380; 1.0355; 1.0340