Lira firms after unchanged CBRT

The Turkish lira firmed on Thursday after the CBRT left interest rates unchanged at 24%, as expected.

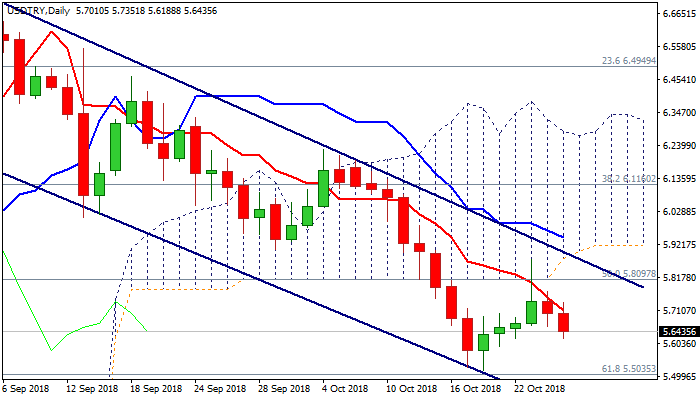

The USDTRY pair holds in red for the second straight day after corrective action from new 10-week low at 5.5182 (18 Oct) stalled at 5.8735.

Base of thick daily cloud (5.8097) marks very strong barrier which limited recovery attempts, keeping short-term bears intact.

The pair moves within bear-channel off 6.8379 (30 Aug high), maintaining bearish bias and focusing pivotal supports at 5.5341 (100SMA) and 5.5035 (Fibo 61.8% of 4.5121/7.1074), break of which would generate fresh bearish signal for further extension of pullback from new record high at 7.1074.

The central bank kept policy unchanged and said would keep tight policy until inflation outlook improves, with further tightening possible if situation worsens.

Stronger lira comes as a result massive rate hike in September, which was described as appropriate action to keep double-digit inflation controlled and regained confidence of traders.

Bearish momentum continues to strengthen and daily MA’s (10;20;30;55) are in bearish setup and supportive for further descend.

Res: 5.6988; 5.8097; 5.8735; 5.8433

Sup: 5.5341; 5.5182; 5.5035; 5.3336