Mild reaction on upbeat US private jobs data keep the pair within tight range ahead of FOMC

The Euro eased from session high at 1.1699 as upbeat US jobs data offered mild support to dollar, but remains in overall neutral mode, moving within 25-pips range ahead of today’s key event, FOMC policy decision.

Upbeat US ADP private employment figures for July (219K vs 186K f/c and upward-revised June release at 181K from 177K), which is usually seen as indication for more important US non-farm payrolls data (due on Friday), had little impact on the pair.

Another release ahead of Fed, US Manufacturing PMI (July f/c 59.4 vs 60.2 in June), is not expected to stronger influence the price action, if release comes within forecasted levels.

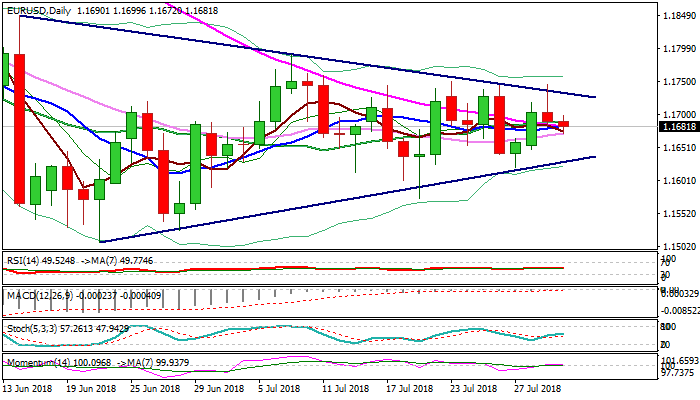

Expectations for hawkish Fed would put the single currency under fresh pressure to extends weakness from Wednesday’s rejection top at 1.1745, towards pivot at 1.1635 (triangle support) firm break of which would be bearish signal.

Weakening momentum and thick daily cloud maintain pressure and support negative scenario.

Res: 1.1699; 1.1718; 1.1736; 1.1750

Sup: 1.1672; 1.1633; 1.1620; 1.1574