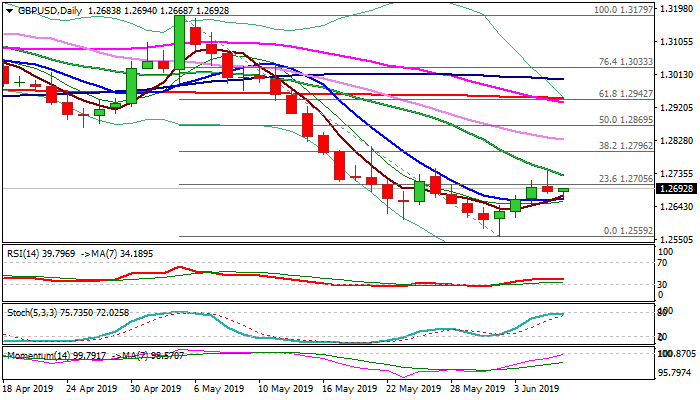

Near-term action holds between 10 and 20SMA’s and looks for signal on break of either side

Cable is consolidating above two-day low at 1.2668, reinforced by 10SMA and awaiting fresh signal from today’s ECB policy meeting.

Recovery leg from 1.2559 low stalled at 1.2743 (capped by falling 10SMA) and subsequent pullback resulted in formation of inverted hammer candle.

The pair looks for initial direction signal on break of pivotal resistance (20SMA / support (10SMA) which could be provided by ECB’s decision.

Conflicting daily indicators (rising momentum / sideways-moving RSI/Stochastic and mixed MA’s) lack firmer direction signal for now.

Overall picture remains bearish and weighed by strong concerns about no-deal Brexit, keeping the downside vulnerable.

Loss of 10SMA support (1.2663) would shift near-term focus lower and increase risk of re-visiting 1.2559 low.

Bullish signal could be expected on sustained break above 20SMA that would open pivotal Fibo barrier at 1.2796 (38.2% of 1.3179/1.2559).

Res: 1.2705; 1.2730; 1.2747; 1.2796

Sup: 1.2663; 1.2610; 1.2580; 1.2559