Near-term action is in neutral mode and looks for fresh direction signals

US CRUDE OIL

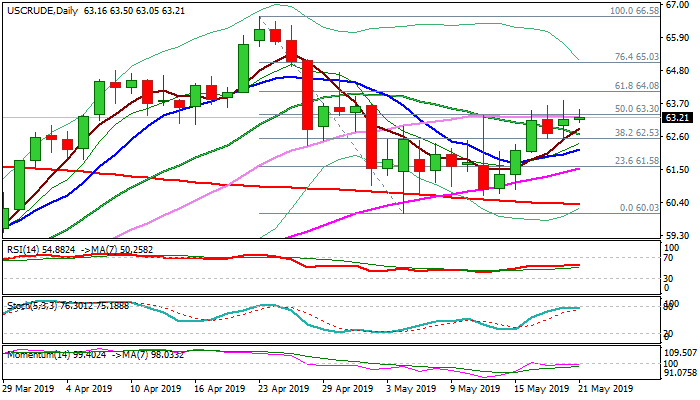

WTI oil holds within tight range on Tuesday after the third consecutive failure to make sustained break above cracked $63.30 pivot (50% retracement of $66.58/$60.03 / 30SMA).

Key factors that influence oil prices, US/Iran tension that threaten of escalation and fears of global slowdown on escalation of US/China trade war, keep in balance for now, holding oil prices in directionless near-term mode.

Weakening daily studies (weakening momentum after repeated failure to break into positive zone and stochastic turning south after touching the border of overbought zone) keep the downside vulnerable.

Bearish scenario needs initial signal on break below the lows of past two days at $62.53 (also broken Fibo 38.2%), with extension and close below 10SMA / daily cloud top ($62.16/02) needed to generate reversal signal.

On the other side, eventual break and close above $63.30 pivot would signal extension of recovery leg from $60.03 (6 May low) towards next pivotal barrier at $64.08 (Fibo 61.8% of $66.58/$60.03 bear-leg).

Traders will look for fresh direction signals from US API crude stocks data, due later today.

Res: 63.30; 63.78; 64.08; 64.73

Sup: 63.05; 62.85; 62.53; 62.16