Neutral near-term mode looks for a catalyst; US NFP data in focus

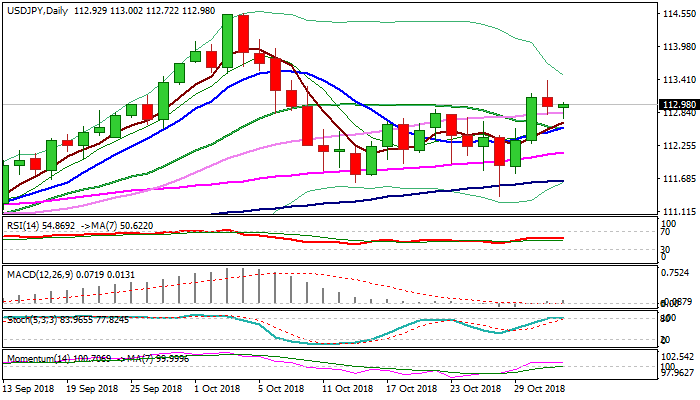

The pair holds in neutral mode on Thursday after bulls from 111.37 low stalled at strong Fibo barrier at 113.33 but subsequent pullback failed to clearly break below initial support at 112.83 (30SMA), keeping near-term action within tight range.

Weaker dollar across the board made bulls to run out of steam, but yen also stands at the back foot after BoJ kept ultra-low rates and signaled that effort to hit its inflation target could be delayed by persisting global trade tensions as well as Japan’s slow wage growth.

Sideways-moving daily indicators support current neutral stance, with direction signals expected on violation pivotal points on both sides.

Bears could expect signal on break below converged 10/20SMA’s (112.55), while break and close above cracked 113.33 barrier (Fibo 61.8% of 114.54/111.37 descend) would signal continuation of near-term upleg from 111.37 (26 Oct low).

US Non-Farm payrolls data on Friday could provide stronger signal. Forecasts show 190K jobs created in Oct, well above previous month’s 134K which could boost the greenback on release near/above consensus.

On the other side, another key release, average hourly earnings, is expected to dip in Oct (0.2% f/v vs 0.3% in Sep) which could sour the sentiment and pressure the greenback on release at/below forecast.

Res: 113.16; 113.33; 113.80; 114.10

Sup: 112.83; 112.55; 112.24; 112.13