Oil is on track for the biggest daily drop this year as fears on new virus variant further dent demand outlook

WTI oil fell over 6% since opening on Friday, in the steepest daily drop this year.

News that new variant of coronavirus, which could be more contagious and possibly resistant to the current vaccines was detected, raised fears that new wave of infections could hurt economic growth and subsequently energy demand.

Lower demand would cause a supply surplus to extend into the first quarter 2022 that would keep oil prices under increased pressure for a prolonged period.

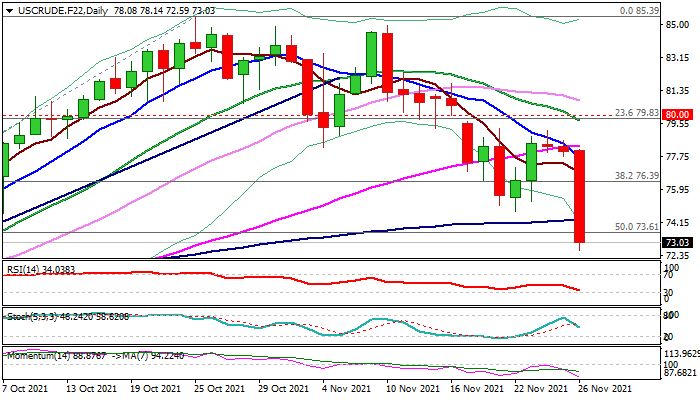

Oil price hit two-month low on Friday and generated strong bearish signal on surge through key Fibo supports at $76.39 and $73.61 (38.2% and 50% retracement of $61.81/$85.39), with weekly close below $73.61 to confirm the signal and increase risk of testing next key levels at $70.00/$69.89 (psychological / 200DMA).

Broken 100DMA ($74.24) and former low of Nov 22 ($74.75) reverted to solid resistances which should ideally keep the upside protected.

Res: 73.61; 74.24; 74.75; 76.39

Sup: 72.59; 71.59; 70.83; 70.00