Oil price bounces strongly after cracking strong support zone

WTI oil price bounced from two-week low on Wednesday, retracing so far a good part of Tuesday’s 2.1% drop, sparked by mostly unjustified optimism over potential positive outcome of US-Iran talks.

Fresh advance (oil price gained 1.6% until mid-European session on Wednesday) suggests that traders remain very cautious, as any escalation of the conflict would likely result in closure of one of key corridors for oil transportation and cause strong negative impact on global supply.

In such scenario, oil prices would skyrocket, with rally towards $150 per barrel (some analysts predict rise above $200 per barrel) expected in immediate market reaction, as many commentators warn that potential war between the US and Iran would immediately engage all countries in the region and will be the biggest military operation since WWII.

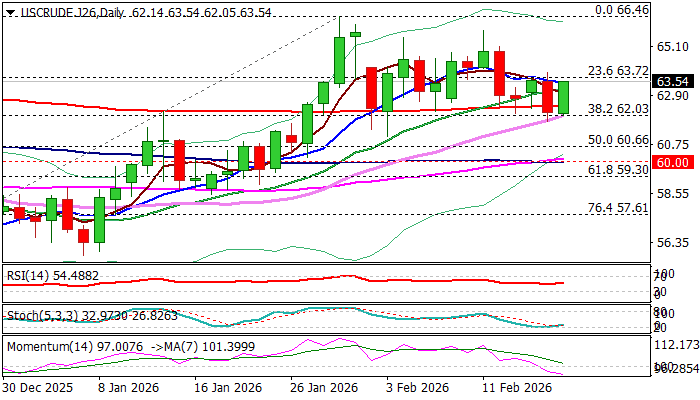

From the technical point of view, we have witnessed a breach of very important supports at $62.43 (200DMA) and $62.03/00 (Fibo 38.2% of $54.87/$66.46 rally / psychological), but the action was short-lived (subsequent bounce prevented formation of strong bearish signal), keeping so far the downside protected.

Today’s large bullish candle (preferably close above $63.50, to create bullish engulfing pattern and boost developing positive signals).

Sustained break above $63.78 (50% retracement of $66.46/$$61.10 pullback) to validate reversal signal and open way for further recovery, as technical studies on daily chart are still conflicting (strengthening negative momentum vs MAs in mainly bullish setup).

Res: 63.72; 64.86; 65.10; 65.82

Sup: 62.43; 62.00; 61.10; 60.66