Oil price maintains bullish bias but negative impact from new wave of virus limits gains

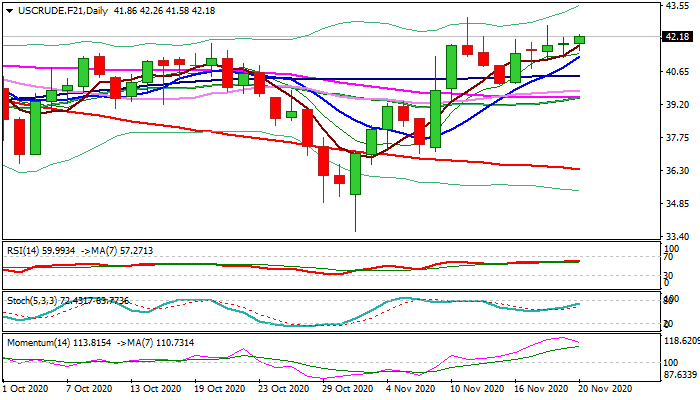

WTI oil price jumps above $42 on Friday, focusing November’s peak at $43.03.

Overall sentiment remains positive as the contract is on track for the third consecutive weekly gain, although the upside attempts remain limited on oversupply, demand concerns over surge in coronavirus cases and renewed lockdowns.

On the other side, hopes for effective Covid-19 vaccine and that OPEC+ group will delay planned production increase, continue to underpin oil prices.

In addition, signs that talks about new US stimulus package would resume, bring more optimism among traders.

Daily studies remain positive but momentum crests and warns that another attempt towards post-pandemic recovery peak ($43.75) may lose steam.

Bulls probe again through 55WMA ($42.02) but another failure to register weekly close above would be initial warning.

Near-term bias is expected to remain with bulls while the price stays above rising 10DMA ($41.28) which tracks the action since Nov 9, while psychological $40 level (also daily cloud top and Nov 13/16 double-bottom) marks key support, loss of which would bring bears in play.

Res: 42.65; 43.03; 43.17; 43.75

Sup: 41.58; 41.28; 40.78; 40.46