Oil prices fall on renewed fears of deepening crisis in banking sector

WTI oil fell significantly on Friday, as fresh fall in European banking stocks, fueled worries that crisis in banking sector may accelerate, souring overall sentiment on darkened demand outlook.

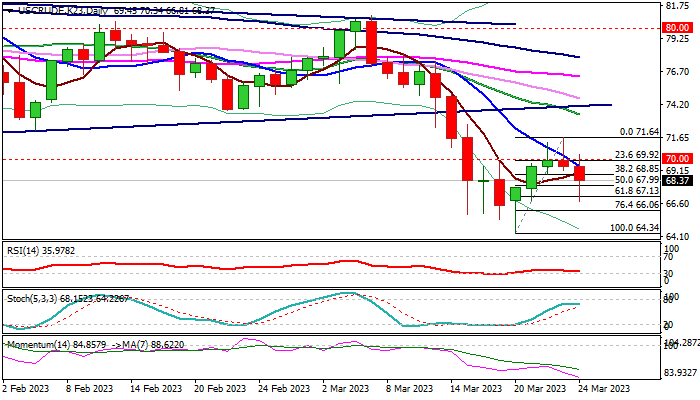

Friday’s drop was signaled repeated strong upside rejection on Thu/Wed, which left daily candles with long upper shadows (pointing to rising offers), as well as a bull-trap above $70 barrier.

Fresh weakness also retraced more than a half of recent $64.34/$71.64 recovery leg, adding to signals that corrective phase might be over.

Rising bearish momentum on daily chart and falling 10 DMA tracking price action after bulls were trapped above this indicator, contribute to growing negative signals.

We look for Friday’s close below $68.00 (50% retracement of $64.34/$71.64 corrective leg) to confirm reversal and shift focus to the downside, with repeated weekly close below psychological $70 barrier, to confirm larger bearish structure.

Bears eye pivotal support at $66.19 (200-week moving average), which so far contained the latest leg lower and new low at $64.34 (2023 low, the lowest since Dec 2021), violation of which would signal continuation of the downtrend from May 2022 peaks at $120.00 zone.

Solid resistances at $69.45 (10DMA) and $70.00 (psychological) should keep the upside protected to maintain bearish bias.

Res: 68.85; 69.92; 70.00; 71.64

Sup: 68.00; 67.13; 66.19; 64.34