Oil prices stand at the back foot ahead of crude inventories reports

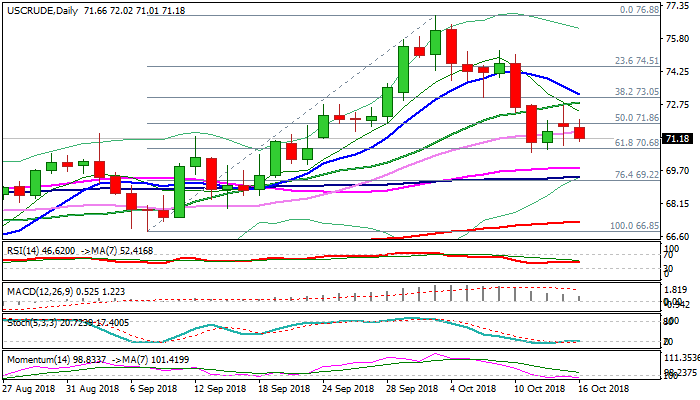

WTI oil was lower on Tuesday after recovery attempts previous day stalled and daily action ended in long-legged Doji, signaling strong indecision.

The prices came under pressure on report that production of US shale oil hit record high and on expectations of further of US oil inventories, with reports of fall of exports from Iran, partially offsetting negative impact.

Today’s action holds in red as negative fundamentals are supported by weak techs, which maintain bearish momentum.

Near-term focus turns on cracked Fibo support at $70.68 (61.8% of $66.85/$76.88 upleg) which so far contained repeated attacks, with break here to signal and end short consolidation and continuation of bear-leg from $76.88 (03 Oct high).

Firm break lower would expose psychological $70 support; daily cloud top ($69.89) and 55 / 100SMA’s ($69.83 / $69.41 respectively) in extension.

At the upside, rising 20SMA which capped Monday’s upticks ($72.81) marks pivotal barrier, break of which would provide relief.

US Crude stocks reports are in focus, with API report due today and EIA report on Wednesday, expected to provide fresh signals.

Res: 72.02; 72.81; 73.19; 73.47

Sup: 71.01; 70.68; 70.49; 70.00