Oil weakness accelerate on rate hike expectations, fading supply worries

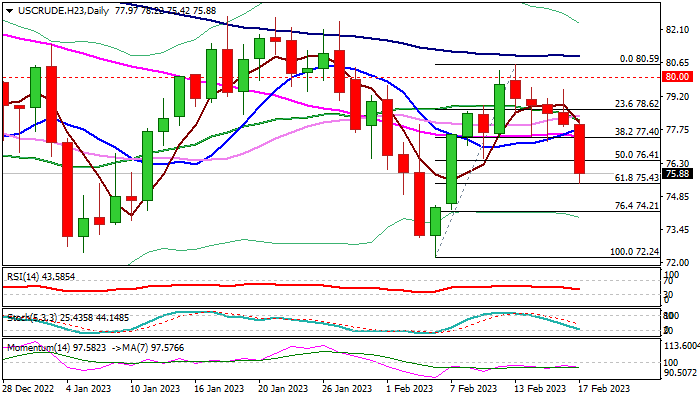

The WTI oil price accelerated lower on Friday, extending the downleg $80.59 high into fifth consecutive day.

The contract was down 2.4% until early US session on Friday, as bears gained pace on expectations of further rate hikes in the US and fading concerns about supply shortages, after Russia announced expectations to maintain current volumes of oil exports, while US crude inventories rose to the highest since mid-2021.

On the other hand, markets expect support to oil prices from expectations of higher global demand, mainly due to expectations of increased Chinese demand.

Today’s acceleration broke through significant support at $76.41 (daily cloud base / 50% retracement of $72.24/$80.59 upleg), with daily close below this level to confirm bearish signal.

Daily studies are in full bearish setup and support the action, which pressures pivotal Fibo support at $74.31 (61.8%), with break here to further boost bears and expose next target at $74.21 (Fibo 76.4%).

The contract is also on track for a weekly loss of over 5% that confirms negative near-term stance and keep oil price vulnerable of further losses.

Res: 76.41; 77.40; 78.82; 79.51

Sup: 75.43; 74.21; 72.44; 72.24